Today the Swedish Central bank was forced to take out an emergency loan from the European Central Bank (ECB). The ECB is not in the habit of issuing such loans to non-members (or members alike). The Guardian reports that the Swedish central bank borrowed €3bn from the ECB as the Latvian emergency causedripple effects.

What on earth could Latvia have to do with foreign currency troubles at the Swedish Central Bank? Here is a possible answer: the very same day, the very same newspaper (Financial Times) reports that

and

Nouriel Roubini provides his assessment of the Lativan crisis and solution. Mary Stokes focusses on contageon.

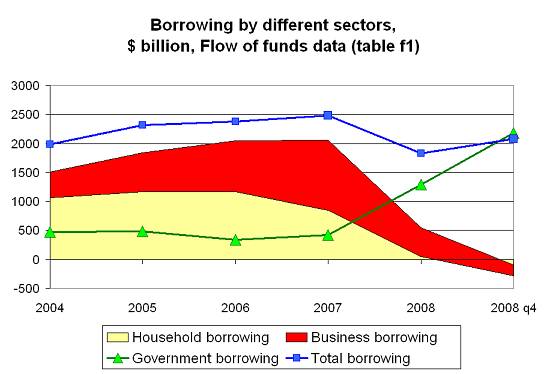

1) Outline how the Latvian Crisis is undermining the Swedish Economy

2) Discuss why either the term "extreme" or "abroad" seems to be inconsistent with the message.

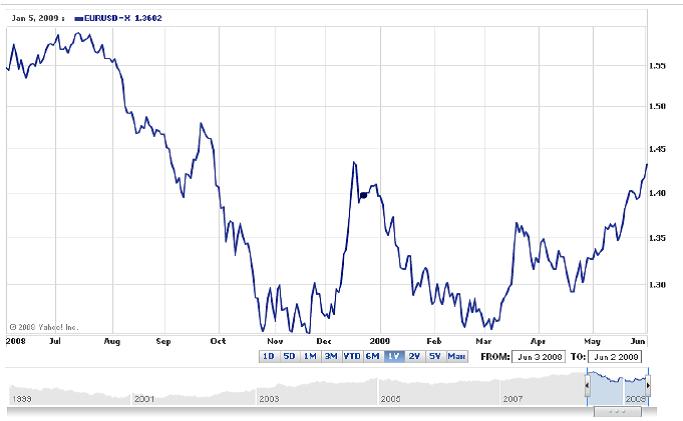

3) Use the Mundell Flemming model to trace Roubini's fear of overshooting.

4) Why would contageon justify the ECB's intervention to aid Swedish banks that are overexposed in Latvia?

[Latvian cyclist] No! Can do it myself!

Cartoon: Gatis Šļūka