Monthly Archives: November 2009

The Dollar Drama

The world is coming to the dollar rescue – or is it self interest?

The Wall Street Journal reports that the World Tries to Buck Up Dollar as Thailand, Korea, Russia Seen Buying U.S. Currency; Pressure on China to Boost Yuan

SUMMARY: Governments stepped up efforts to stem the dollar's slide amid increasing concern about the impact of its weakness on their economic recoveries.

QUESTIONS (from the Journal-in-Education program):

1. What determines the value of the dollar on foreign exchange markets?

2. What accounts for the recent slide in the value of the dollar?

3. What are the economic consequences of the depreciating dollar?

4. What can the government do, if anything, to mitigate the fall in the value of the dollar?

5. What are the implications of the depreciation of the dollar on monetary policy? Does the

fall in the value of the dollar affect the Fed's ability to achieve it's goals?

.jpg)

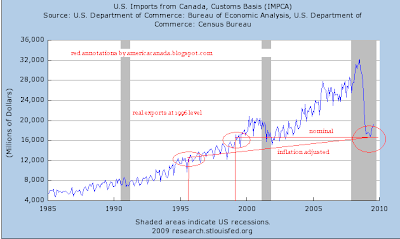

Buy American – The Flip Side

I have previously discussed the Buy American measures that are designed to induce expenditure switching.

Here is an extract from a Canadian blog that highlights why such provisions are so unpopular with trading partners….

Exports and Buy America:

Exports to the United States have fallen nearly 50%, in part thanks to “Buy America”.

I was just transferred from our Mississauga, ON offices to Hamilton, and I get the pleasure of driving through the steel armpit of Ontario daily. US Steel purchased Stelco, our largest steel manufacturer, two years ago and just after it received hundreds of millions from Ontario’s provincial government to keep operating. Within days of “Buy America”, US steel shut down the Canadian Stelco plant.

A few months ago, as the benefits for the laid off workers dried up, US Steel was notified that they would have to either bring the workers back or pay out their pensions. US Steel decided to bring them back to work. Instead of making steel, they painted all the buildings in a fresh coat of blue paint. If you understand the size of the Stelco plant and buildings, then you can understand what a formidable task this was.

A couple weeks after it now appears that all the buildings are blue and the workers have been laid off again. However the steel mill now sends clouds of pollution miles high in the sky. I have been told by some locals that the US Steel sends its iron ore to the plant to be refined. Once refined it is put back on the ship and sent to one of their US plants – most likely in Gary Indiana – to be turned into steel. So we get the pollution up here but none of the profits or labour. The government of Canada has taken US Steel to court for $10 million per day for breach of contract.

Wait until more Canadians find out about this. “Buy Canada’, or more plausibly, “Do Not Buy America” will gain steam. We’re a free trade country by and far, but “Buy America” has been a hard hit below the belt for most of us.

Mother of all Carry Trades

Nouriel Roubini (aka Dr. Doom) is making the case for another bubble in financial markets (he is one of the few economists who predicted the 2008 crash). Read the article and the following questions

1) What is behind the massive rally in the prices of risky assets?

2) Why is the fed holding interest rates at zero?

3) How does the fed policy affect carry trades? Given an example of a trade and highlight why it is so attractive

4) Why does the current carry trade dynamics affect the value of the dollar?

5) Does a dollar depreciation make carry trades more or less attractive?

6) How can trader get a negative 20 percent interest rate? Someone is PAYING the trader to take the money?What does Roubini mean?

7) As the zero interest policy in the US led to the vast expansion of carry trades, what was the response of other foreign central banks in Asia and Latin America?Why and how did they act?

8) At some point in the article Roubini switches back to the US and – despite carry trade opportunities –indicates that the fed policy may have also created an asset bubble in the US. Outline hisreasoning.

9) How will the bubble burst and why? Be specific. How likely are these events?

Here is a picture that drives home the attraction of carry trading…

Crisis Reference Material

Helpful Teaching Aids from the NY Fed:

Comprehensive graphics that detail the US and international policy response to the crisis.