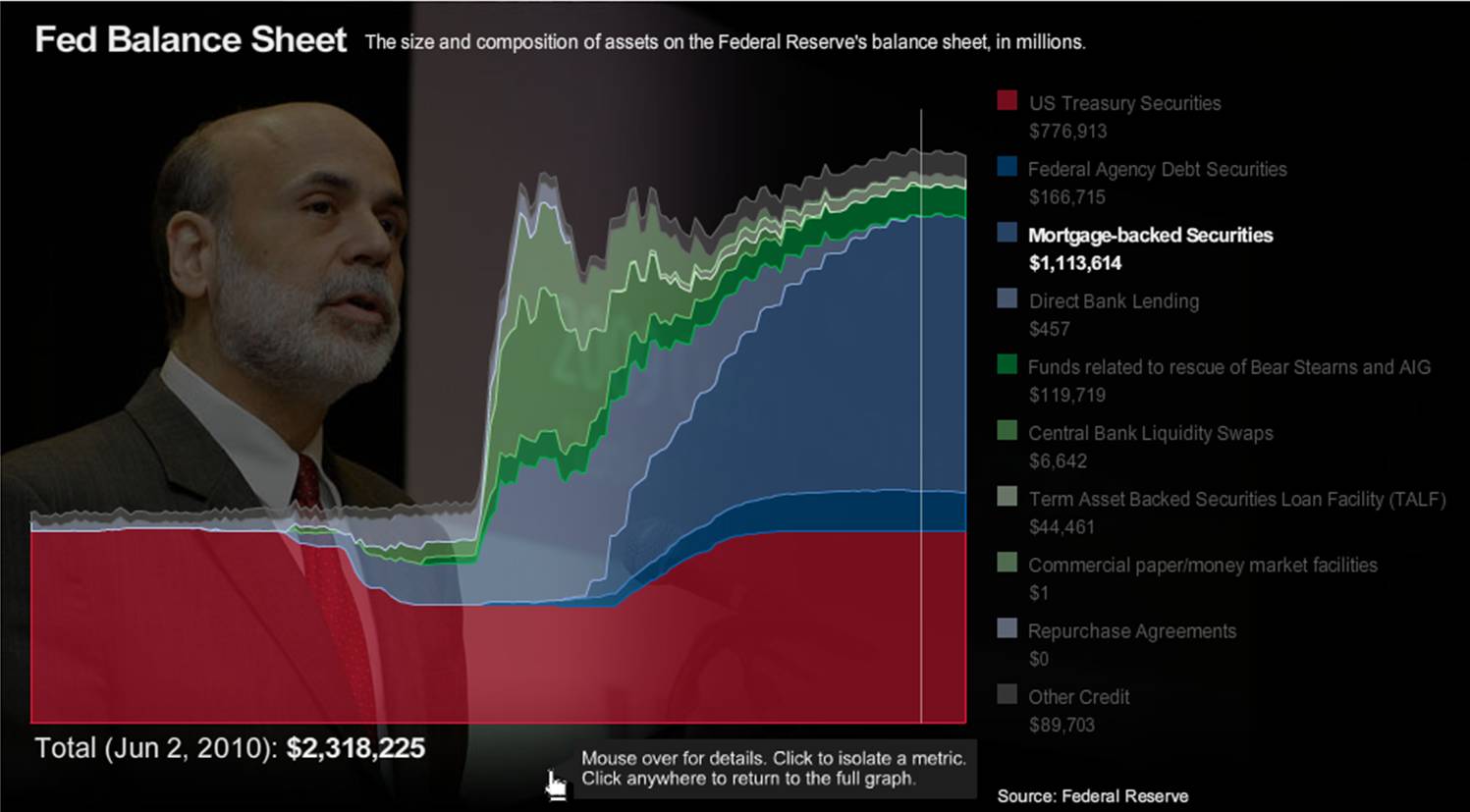

The only way you can get behind the massive government stimulus is if you believe that a one-time defibrillation is needed to resuscitate the economy from its liquidity trap. If you do not believe that we are in a liquidity trap, there is no need for stimulus and all the money spent is simply wasted without effect (other than increasing the public debt).

There is now ample evidence that the stimulus was large enough to stop the economy from going over the cliff – economic growth has recovered. However, at the same time, the stimulus was not large enough to result in large scale hiring or investment. That's a major problem. The defibrillation returned a heart beat, but the patient is still in a coma.

Many had argued that the stimulus was too small at the time. I didn't do the math at the time whether the size was right, but was astonished how unproductive much of the spending actually was. Unproductive in actually putting people to work. Of course, in his General Theory, Keynes wrote, “To dig holes in the ground, paid for out of savings, will increase, not only employment, but the real national dividend of useful goods and services.” So the take-away was "it does not really matter what the stimulus is being spent on, as long as its spent. But it turns out that out insufficient size or productivity in terms of the # of people put to work matter for a stimulus. Here is how the unusually creative and brilliant Robert Schiller puts it in the NYT (via Mark Thoma).

What Would Roosevelt Do?, by Robert J. Shiller, Commentary, NY Times: Across the United States, thousands of federally financed stimulus projects are under way, aimed at bolstering the economy and putting people to work. The results so far have not been spectacular.

Why not? There’s nothing wrong with the idea of fiscal stimulus itself. We need more stimulus, not less — but we need to focus much more on actually putting people to work.

Two friends of mine, both economists, came upon a stimulus project … highway … sign that read “Putting America to Work: Project Funded by the American Recovery and Reinvestment Act” and prominently featured a picture of a worker digging with a shovel. Out on the road, there was plenty of equipment, including a gigantic asphalt paver, dump trucks, rollers and service vehicles. But there wasn’t a single laborer with a shovel. That project employed capital, certainly, but not many human beings.

Like many such stimulus projects, it could be justified if you accept the idea that gross domestic product, not jobs, is central — a misconception…

So here’s a proposal: Why not use government policy to directly create jobs — labor-intensive service jobs in fields like education, public health and safety, urban infrastructure maintenance, youth programs, elder care, conservation, arts and letters, and scientific research?

Would this be an effective use of resources? From the standpoint of economic theory, government expenditures in such areas often provide benefits that are not being produced by the market economy. …

President Franklin D. Roosevelt's New Deal, though no more than partly successful, was much more focused on job creation than our current economic stimulus has been. It seems that the New Deal was also more successful at inspiring the American public.

Consider one of the most applauded of Roosevelt’s programs, the Civilian Conservation Corps, from 1933 to 1942. … The C.C.C. emphasized labor-intensive projects… Congress has recently set plans for tripling the size of AmeriCorps, the modern counterpart of the C.C.C…. At its peak, the C.C.C. employed 500,000 young men. Under current plans, AmeriCorps would top out at 250,000 people in 2017, even though the nation now is two and a half times larger. We ought to be bolder.

Big new programs to create jobs need not be expensive. Suppose the cost of hiring a single employee were as high as $30,000 a year, several times typical AmeriCorps living allowances. Hiring a million people would cost $30 billion a year. That’s only 4 percent of the entire federal stimulus program… Why don’t we just do it?

This would take care of the necessary income effect to exit the liquidity trap. Appropriately targeted tax cuts could stimulate investment. But a basic result in economic theory is that temporary tax cuts have very limited effects, and the debate about the semi-permanent Bush tax cuts is still raging (see here and here and here)…