Austerity protests are growing violent in Europe, and we are not just talking about Greece. Here is a summary of Austerity measures that European countries have instituted to avoid debt crises (spiraling public deficits that increase country risk). Its the cost of maintaining membership in the Eurozone. Other countries "simply" devalue – not that devaluation is without costs, they are just not that obvious. Here is a good exercise: lists the costs and benefits of staying in the Eurozone, and the costs and benefits of a devaluation.

Monthly Archives: September 2010

Currency Wars

The world at war; the weapon: depreciation. Brazilian Finance Minister Guido Mantega has warned in remarks reported from Sao Paulo. "We're in the midst of an international currency war, a general weakening of currency," he said in remarks reported by the Financial Times newspaper. "This threatens us because it takes away our competitiveness." Japan, South Korea and Taiwan have intervened recently to pull down the value of their currencies, the newspaper noted, and the dollar has fallen by about 25 percent so far this year against the Brazilian real. Such a decline increases the price of Brazilian exports on the US market.

Barry Eichengreen provides a summary of the economic implications of currency wars. Here are a few study questions

- Why is China keeping its exchange rate artifically low?

- Why are the US and Europe contemplating weaker currencies?

- How are these policies related to beggar-thy-neighbor effects?

- What are the alternatives to beggar-thy-neighbor policies?

- Is it the currency war itself the source of the tensions between the US, Japan, and Europe,

or is it the execution of the currency war the real problem? Explain. - Who is the winner in this war?

Gimme a “B”

Looks like the PIIGS are about to get company. For a change it is political risk, not immediate financial risk that is leading the Financial Times to ask if Belgium is next. The Bond Markets will tell…

Greece: The Soap Opera

Here is the WSJ video take on it, but Michael Lewis tells the tall tale best, as usual

The Smoking Gun

15 Months

That's how long it took for a the NBER Eggheads to locate the bottom of the recent economic downturn – which is also associated with the end of the recession. As we know by now, the patient is recovering but much slower than we have seen after previous recessions. That's because this is the only recession that involved (or indeed was started by) a banking crisis — other than the great depression. In "Diminished expectations, double dips, and external shocks: The decade after the fall," Reinhart and Reinhart outline why the 2008 collapse of the US banking sector makes this recovery special.

Credit Suisse tells us in a few pictures why the the past year since the end of the recession is still not feeling like a "Recovery."

The Actual Value Of The Yuan

There is a lot of hype that the Chinese are manipulating their exchange rate. Unfortunately the discussion usually involves the nominal exchange rate – which does not indicate the real value of the currency. Nor does it indicate the actual competitive edge that the Chinese exchange rate policy is actually creating. Menzie Chinn has the whole story, here are his is his post:

The debate over the yuan's value is heating up again. [Free Exchange/RA] [WSJ RTE/Talley] [WSJ RTE]. Here is a plot of two relevant time series.

Figure 1: Real trade-weighted value of CNY from BIS (blue, left axis), and nominal CNY/USD exchange rate (monthly average of daily rates). + denotes 9/15/2010 observation. Dashed line at de-pegging in July 2005. Source: BIS, and St. Louis Fed FREDII.

Two quick observations. First, the Chinese trade weighted real exchange rate is the relevant one for the world economy; the USD/CNY nominal exchange rate has some importance for the US-China trade balance, but less so for the US overall trade balance — which is the relevant aggregate.

Second, the trade weighted CNY was appreciating before the crisis, and the CNY has largely reverted to that trend over the past few months, after a detour associated with the dollar appreciation during the financial crisis and flight to safety. This observation, however, does not speak to whether the level of the rate is appropriate for moving the Chinese current account to a sustainable level. Additional (relevant) graphs in this post.

The Great Divide

The divide between political rhetoric and economic reality in Europe is growing. Former IMF chief economist Simon Johnson along with Peter Boone have the summary:

As usual, Nouriel Roubini tells us how deep Europe could side in all different dimensions. (Remember, Roubini earned only hearty laughs when he predicted the 2008 financial crisis in 12 easy steps too scary for anyone to take seriously – then it all came true, just worse than even he had predicted…

Here is the update on Euro Bond Spreads. Looks like markets are getting quite confident about default – then why is the Euro so strong? – Because US interest rates are zero… Try Interest Parity…

Beggar Thy Neighbor

The newswires are abuzz with the news of the Japanese Central Bank intervention. Some commentators realize that the ancient term for "dollar mercantilism", "neo-mercantilism", or "competitive depreciation" is simply "beggar thy neighbor" (see Chapters 19). The Economist Magazine has an interesting take on the issue. IF the Japanese intervention floods the market with dollars and IF this would lead to inflation in Japan – the effect might actually be positive for all!

Extra Credit: How would you use the large open economy Mundell Fleming Model (Chapter 19) to explain how the massive sale of yen by the Japanese Central Bank could benefit not only Japan but also the US (and other countries). Hint: Think Liquidity Trap, and The Paradox of Thrift…

Solution: Combine 1, 2, for an alternative view (see 3, which is the "great vacation" view of the great recession. I contrasted these views before…).

Chinese Dollar Mercantilism

Time for a short list of links to Chinese Mercantilism, which is blamed for an annual loss of 1.4 million jobs in the US.

The mechanics of "Dollar Mercantilism" – why China is buying $

Effects of Dollar Mercantilism on the US

Krugman's back of the envelope US job-loss calculation

Krugman's "Taking On China", calling for a 25% tariff against Chinese goods

Ralph Gomeroy "Jobs, Trade, Mercantilism" Part 1 & Part 2

Peter Morici's Currency Conversion Tax to End Mercantilism

Fred Bergsten's "Correcting the Chinese Exchange Rate: An Action Plan"

Levy, Philip “U.S. Policy Options in Response to Chinese Currency Practices”

Love (Hate) Triangle

Today the Japanese Central Bank intervened (for the first time in 6 years in international currency markets). BBC has the story:

Japan moves to combat rising yen

The Japanese central bank stepped in to sell yen and buy dollars, a day after the yen hit a 15-year high against the dollar.

It is the first time in six years that the Bank of Japan has intervened, and further action has not been ruled out. A strong yen makes Japanese exports more expensive, and reduces profits when earnings are repatriated.

In early trading on Wednesday, the dollar rose to 85 yen, after hitting 83.09 yen on Tuesday. Investors welcomed the intervention, sending Japan's Nikkei share index up by 2.9% at first, with the index eventually closing 2.34%higher at 9,516.56.

Economic harm

But in a brief news conference, Finance Minister Yoshihiko Noda said: "We have conducted an intervention in order to suppress excessive fluctuations in the currency market. "We will closely monitor currency developments, and take firm action including intervention… The yen's rapid appreciation "harms the stability of the economy and finances. We cannot tolerate it."

Japanese exporters praised the intervention. "From the standpoint of aiding the competitiveness of Japan's manufacturing industry, we applaud the move by the government and the Bank of Japan to correct the yen's strength," carmaker Honda said in a statement. Honda's shares closed up4%, while Sony, another big exporter, ended 4.2% higher… A recent government survey suggested many companies were considering moving production overseas if the yen stayed high.

The record low for the dollar is 79.75 yen, reached in April 1995. Mr Noda did not reveal the size of the intervention, although the Dow Jones news agency reported that Japan's Ministry of Finance had initially sold between 200bn and 300bn yen ($2.4bn-$3.6bn).

But who is buying the Yen? The Japanese economy has been anemic since the early 1990s (the Japanese stock index has fallen by roughly 66% in the last 20 years).

Ok, so the Chinese government has been buying Japanese bonds, but their $20 billion purchases this year, cannot be the whole story. Reuter's makes an attempt to explain the recent movements using interest parity (yield spreads) and sterilization – none of it convincing. The one interesting piece is that the REER has actually not moved much less than the nominal exchange rate because of Japanese deflation.

Here is a final thought: when will we hear about Japanese "Mercantilism?"

The Wall Street Journal spells out the Love (Hate) triangle all its juicy details:

China has been diversifying its $2.5 trillion reserves away from the dollar, causing some to worry that less Chinese buying of Treasurys would cause U.S. interest rates to and make it more difficult for the government to borrow.

But Japan’s dollar buying in currency markets Wednesday shows Chinese reserve diversification might actually lead to even more demand for Treasurys.

Here’s how. As China diversifies out of U.S. dollar-denominated assets such as Treasurys, it is buying debt denominated in the currencies of some of its biggest trading partners. Not wanting to lose competitiveness themselves, those trading partners in turn buy dollars to keep their currencies cheap.

As part of the diversification push, China has been a major buyer of yen, snapping up $27 billion in yen so far this year according to Japanese Ministry of Finance. Analysts say China’s buying has helped an already strong yen get stronger.

Now, Japan, feeling under pressure to weaken its currency, turned around and bought dollars, most likely in the form of Treasurys. It isn’t clear exactly how much dollar buying Japan will have to do to protect the yen from getting stronger, but it’s likely to more than offset China’s diversification into the yen. If the past is a guide, Japan spent $320 billion in its last intervention from 2003 to 2004. And this time the currency markets are 73% far larger, with $568 billion dollar-yen trading a day, according to the Bank for International Settlements.

Japan is not alone in this phenomenon. China has also bought South Korea’s currency, the won. And South Korea routinely intervenes in currency markets, buying dollars to keep its currency from rising too quickly, again offsetting China’s move out of the dollar.

Mercantilism in a Large Open Economy

Dani Rodrik expounds the virtues and pitfalls of the Chinese exchange rate manipulation. For a change, he does not focus on US-Chinese economics, but on the impact of the undervalued Yuan on poor countries.

a) use the large open economy diagram to show how the absence of FX intervention no the part of the Chinese Central Bank, and the associated one-time depreciation of the Chinese yuan, would affect China and poor countries

b) explain why the artificially weak Yuan is equivalent to Mercantilism or Neo-Mercantilism.

c) If China implements high tariffs on imported goods, do you think that its propensity to import is big or small?

d) What would such a tariff mean for output in poor countries that reply on China as a trading partner?and How does this relate to Rodrik's point abou the poor countries' core problem?

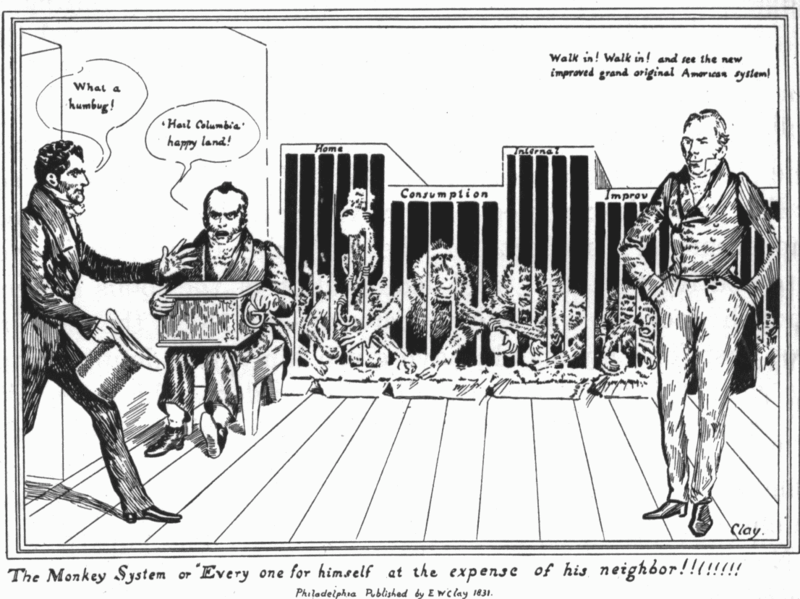

It turns out the US has its own history of trade manipulation. Cartoonist E.W. Clay published the below cartoon in 1831 to lampoon the "American System" of Protection as a "Monkey System" where "Every one for himself at the expense of his neighbor!"

(Source)

The “American System,” was the first US government-sponsored attempt to invigorate

the national economy through trade manipulation. It implemented Alexander Hamilton’s ideas, as outlined in his 1792 “Report on Manufacturers.” At the time he proposed a protective tariff of 20-25 percent on imported goods – such as woolens, cottons, leather, fur,

hats, paper, sugar and candy, to protect the nation’s fledgling

industries from foreign competition. Congress finally passed the tariff in 1816.

V-Shaped Dreams

If Not Now Then When

This graph from Paul Swartz at the Council of Foreign Relations shows the time structure of Greek default probabilities for three different dates: The market oracles thus that default will occur sometime around 24 months from now…

These probabilities are based on risk spreads between German (aka "risk free") and Greek bonds. The IMF, does not seem to have a subscription to the same data. Greek debt default is unlikely according to IMF… Debt default by an advanced economy such as Greece is “unnecessary, undesirable and unlikely”, according to an IMF paper released yesterday.

This runs against market sentiment according to which Greece will eventually restructure its debts, writes the FT. I guess the story is that "once Greece has cut its deficit to zero, it will not need any new borrowing to finance its budget. Examples in the past 20 years, like Belgium in 1984 or Italy in 1991,showed that when these advanced economies cut their deficit none of went on to default." Time will tell…