Not so says Tim Duy

Meanwhile, the international fallout from the oil price drop continues. Russia is a classic emerging market crisis story. The decline in energy prices reveals a currency mismatch between assets and liabilities. The decline in oil dries up the dollars needed to support those liabilities, so the value of the ruble is bid down as market participants scramble for dollars. One suspects that capital flight from Russia only aggravates the problem; those oligarchs are seeing their fortunes whither. Currency plummets, aggravating the cycle. The sanctions were the beginning of this crisis, the oil price shock the culmination.

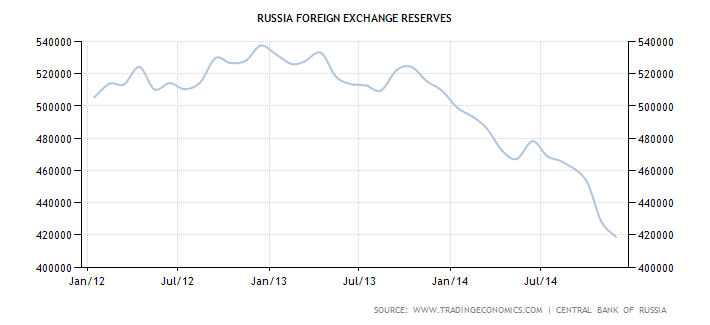

The Central Bank of Russia is forced into defending its currency via either depleting reserves or hiking interest rates. Both are losing games in a full blown crisis. The Central Bank of Russia has tried both, upping the ante by jacking up rates to 17% this afternoon, a hike of 650bp. That, however, is no guarantee of stability. Tight policy will crush the financial sector and the economy with it, triggering further net capital outflows that my guess will swamp the net inflows the rate hike was intended to create. Everything heads into free-fall until a new, lower equilibrium is established.

It is all appears really quite textbook. At this point, an IMF program would be on the horizon. But that's where the textbook changes. Hard to see the IMF just handing out a lifeline to an economy probably viewed by most as currently invading its neighbor (that's the point of the sanctions after all). And I am guessing that Russian Premier Vladimir Putin is not going to easily acquiesce to an IMF program in any event. At the moment, looks like Russia is toast. (Update: Arguably I am being a little pessimistic here. Joseph Cotterill points out that the rate hike falls well short of 1998.)

Venezuela is heading down the tubes as well, but that was always a given. Just a matter of time on that one.