Here is a great article that tries to nail Chinese “off-shore” capital in the presence of Chinese capital controls:

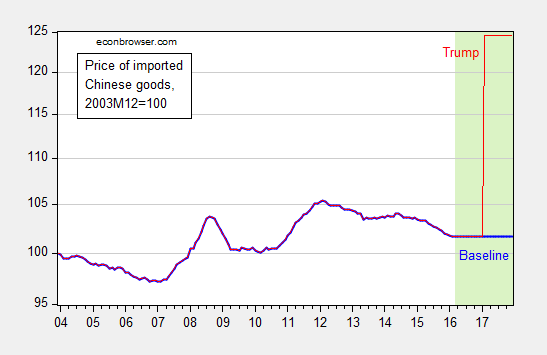

Achieving the goal of autonomous monetary policy (in order to sustain growth) can be accomplished by either further currency depreciation, or tightening capital controls. The extent to which a combination of these policies will have to be pursued depends in part on how much capital outflow persist, with some observers holding apocalyptic views (e.g., “people are panicked”). On this count, McCauley and Shu provide a more nuanced view of the source of outflows.

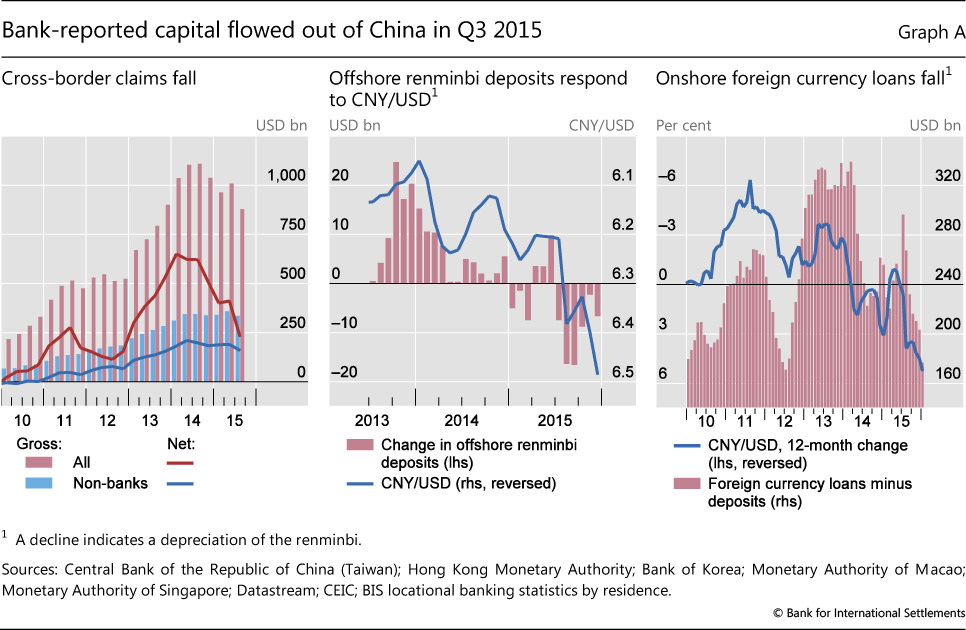

Persistent private capital outflows from China since June 2014 have led to two different narratives. One tells a story of investors selling mainland assets en masse; the other of Chinese firms paying down their dollar debt. Our analysis favours the second view, but also points to what both narratives miss – the shrinkage of offshore renminbi deposits.