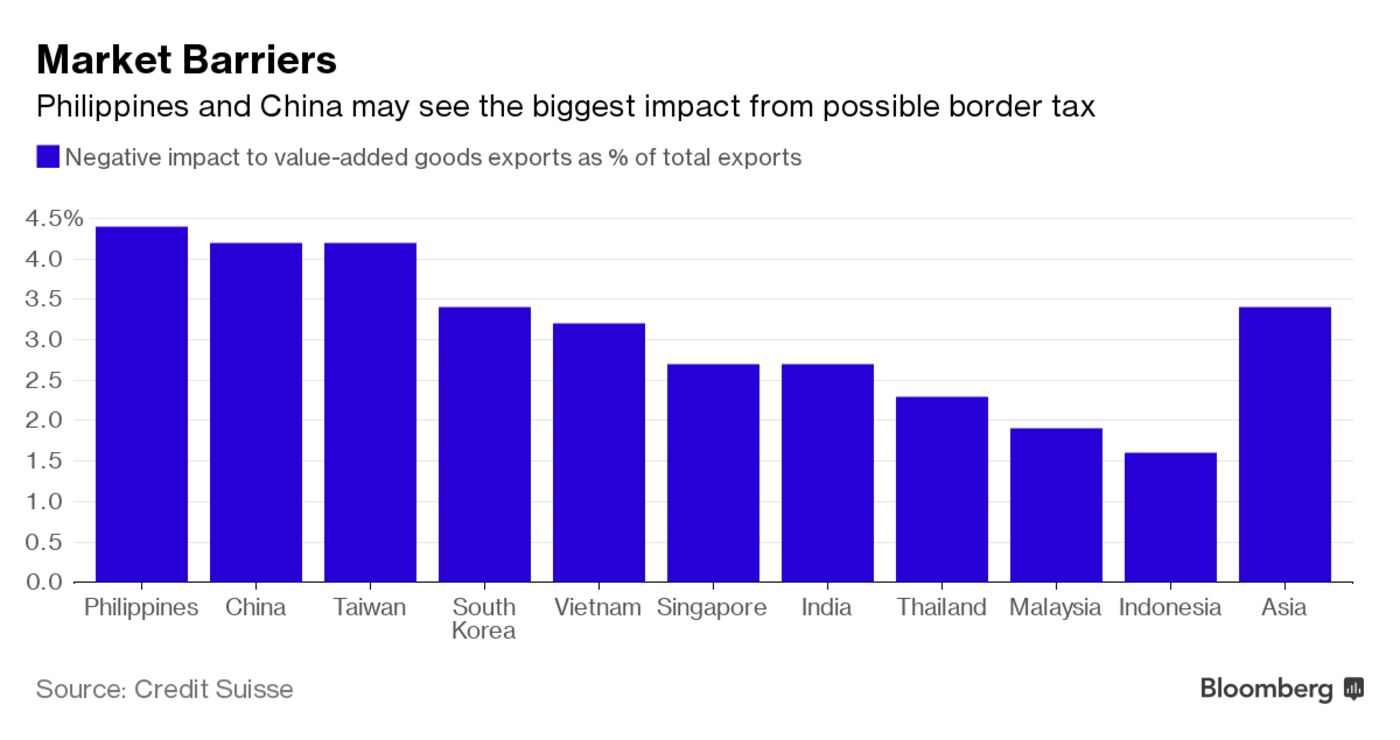

Tariffs and Export Subsidies are blatant violations of WTO rules. The new new thing in protectionism is the “Border Adjustment Tax.” Congress and President Trump are preparing their own versions, but here is a nice description of this veiled tariff:

“Essentially, companies would be able to deduct from their U.S. Federal tax filings the cost of goods and wages produced in the U.S. and exclude any revenue from exports. To illustrate Company A is a retailer who buys its products from China (think Walmart). Lets say it has $1 billion in revenue and spends $100 million on its stores and employees and $800 million on imported goods. The resulting profit of $100 million would be taxed at 35%, producing a $65 million after tax net profit. Under a border adjustment tax it still produces a $100 million profit before taxes but now it’s tax profit is considered to be $900 million ($100 million real profit plus $800 million in non deductible imports). The FIT would now be $315 million (35% of $900 million) producing a net loss of $215 million. To keep producing a 10% after tax profit Company A now has to increase its prices about 25%.

Now Company B is an export driven company (think Boeing). It produces $1 billion in revenue like Company A but 80% of it’s sales are exported with its costs in the U.S. being $900 million producing a $100 million dollar profit before tax and $65 million after tax. For tax purposes they only have to declare $200 million in U.S. sales (the $800 million in exports is not considered revenue for tax purposes). Under the new approach Company B would declare $200 million in revenue and $900 million in expenses for a tax loss of $700 million with a tax refund of about $250 million bringing their after tax income to $350 million ( $100 million normal profit plus a tax refund of $250 million).”

Note that, while companies would no longer be able to deduct the cost of their imported goods, and the sales of their exports would no longer be subject to U.S. taxes. That means American companies could reduce the prices for products they sell abroad, a simply veiled export subsidy.

Oh Boy, so much for Republicans simplifying the tax system. This is rife for transfer pricing games. The tax is supposed to raise about $100 billion/year, to offset the $500 billion hole created by the proposed reduction in the corporate income tax from 35% to 10%.  More wonkish info available here

More wonkish info available here