Politico reports about TRUMP’S AUTO TARIFF SURPRISE: What started Wednesday as a cryptic tweet from President Donald Trump ended in the evening with the Commerce Department launching a Section 232 [effect of imports on national security] investigation into whether to restrict imports of cars, trucks and auto parts. Trump requested the probe into whether auto imports could justify a 25 percent tariff to protect U.S. national security, a senior administration official confirmed to POLITICO.

The response from the US auto industry was unsurprisingly negative. “To our knowledge, no one is asking for this protection,” said John Bozzella, the CEO of Global Automakers.

The investigation could take several months to complete, but few think it will take that long. Indeed that same night, Commerce Secretary Wilbur Ross night laid out the facts justifying the trade probe: “There is evidence suggesting that, for decades, imports from abroad have eroded our domestic auto industry.” That sure looks like a threat to national security; looks like the Commerce Department has their facts at the ready.

All roads lead to NAFTA: The news was viewed by some observers through the lens of the NAFTA talks that have focused almost obsessively on auto issues. A final deal is hung up on the willingness of Mexico and Canada, the two largest exporters of cars to the U.S., to accept new content rules that could potentially alter existing supply chains to the benefit of U.S. production.

Trump appeared to link the two issues on Wednesday, when he told reporters that he felt the auto industry would “be very happy with what’s going to happen. You’ll be seeing very soon what I’m talking about. NAFTA is very difficult. Mexico has been very difficult to deal with. Canada has been very difficult to deal with. They have been taking advantage of the United States for a long time. I am not happy with their requests. But I will tell you, in the end, we win. We will win, and we’ll win big.”

Argentina needs some $30bn in standby funds, perhaps more.

Argentina needs some $30bn in standby funds, perhaps more. Source:

Source:

[2]___Super_Portrait.jpg)

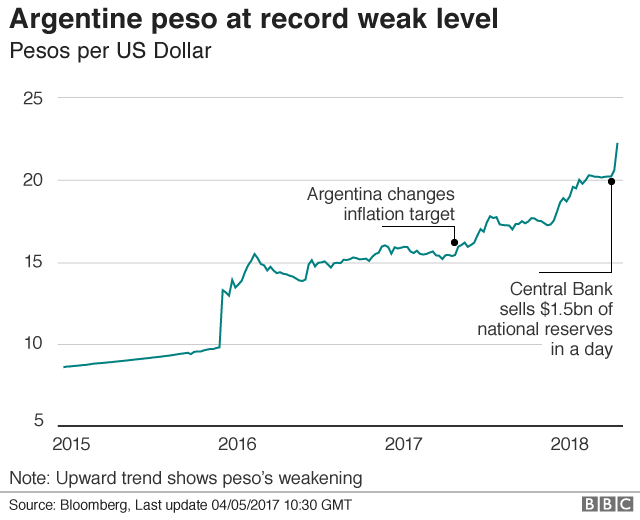

Things have taken a rather dramatic turn for the worst over the past two weeks. After the central bank hiked rates three times in the space of a week for a total of 1,275 basis points in an effort to arrest the slide in the peso. But that wasn’t enough as the Argentinean Peso (ARS) careened to a new all-time low ahead of another CB rate decision.

Things have taken a rather dramatic turn for the worst over the past two weeks. After the central bank hiked rates three times in the space of a week for a total of 1,275 basis points in an effort to arrest the slide in the peso. But that wasn’t enough as the Argentinean Peso (ARS) careened to a new all-time low ahead of another CB rate decision.