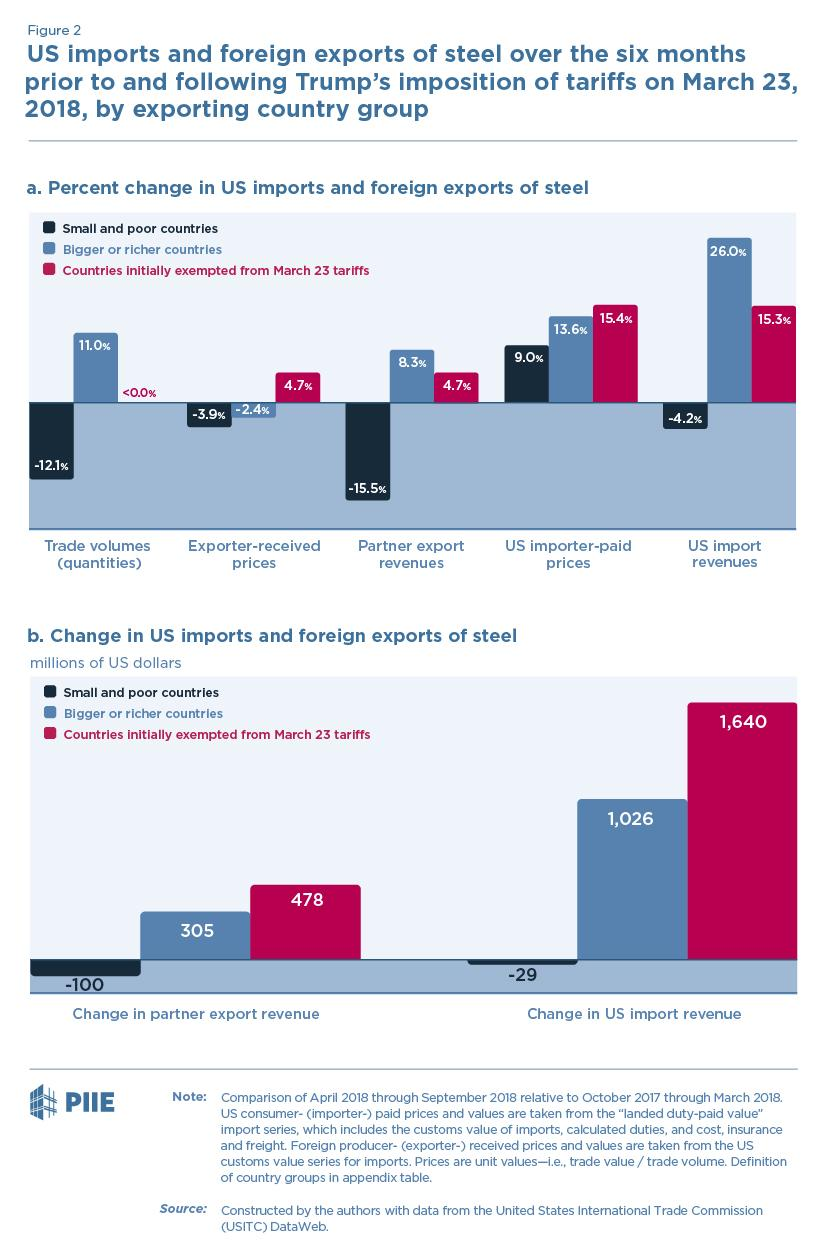

There were an estimated 775 million undernourished people in 2014 and that number increased to 815 million in 2016. In 2016 23% of children in the world are “stunted,” meaning they are too short for their age as a result of chronic malnutrition (link). But in the US food is rotting by the tons as farmers cannot afford the harvest or storage prices now that Trump’s trade policy has closed key global export markets. A good application of the “large open economy” effect where the lack of exports depress domestic prices.

The gap between US and Brazil (World) soybean prices is substantial:

Source: CNBC.