The BBC reports that Argentina imposes currency controls to support its economy, again.

Argentina reportedly imposed currency controls to stabilise financial markets as the country faces a deepening financial crisis. The government restricted foreign currency purchases following a sharp drop in the value of the peso. Individuals can continue to buy US dollars, but they need permission to purchase more than $10,000 a month. Firms have to seek central bank permission to sell pesos to buy foreign currency and to make transfers abroad.

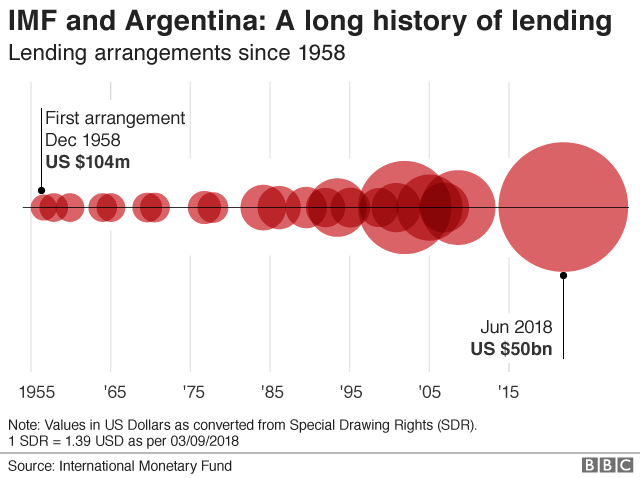

Argentina is also seeking to defer debt payments to the International Monetary Fund (IMF) to deal with the crisis.

What has the government said?

In an official bulletin issued on Sunday, the government said that it was necessary to adopt “a series of extraordinary measures to ensure the normal functioning of the economy, to sustain the level of activity and employment and protect the consumers”.

The central bank said the measures were intended to “maintain currency stability”

What triggered the current crisis?

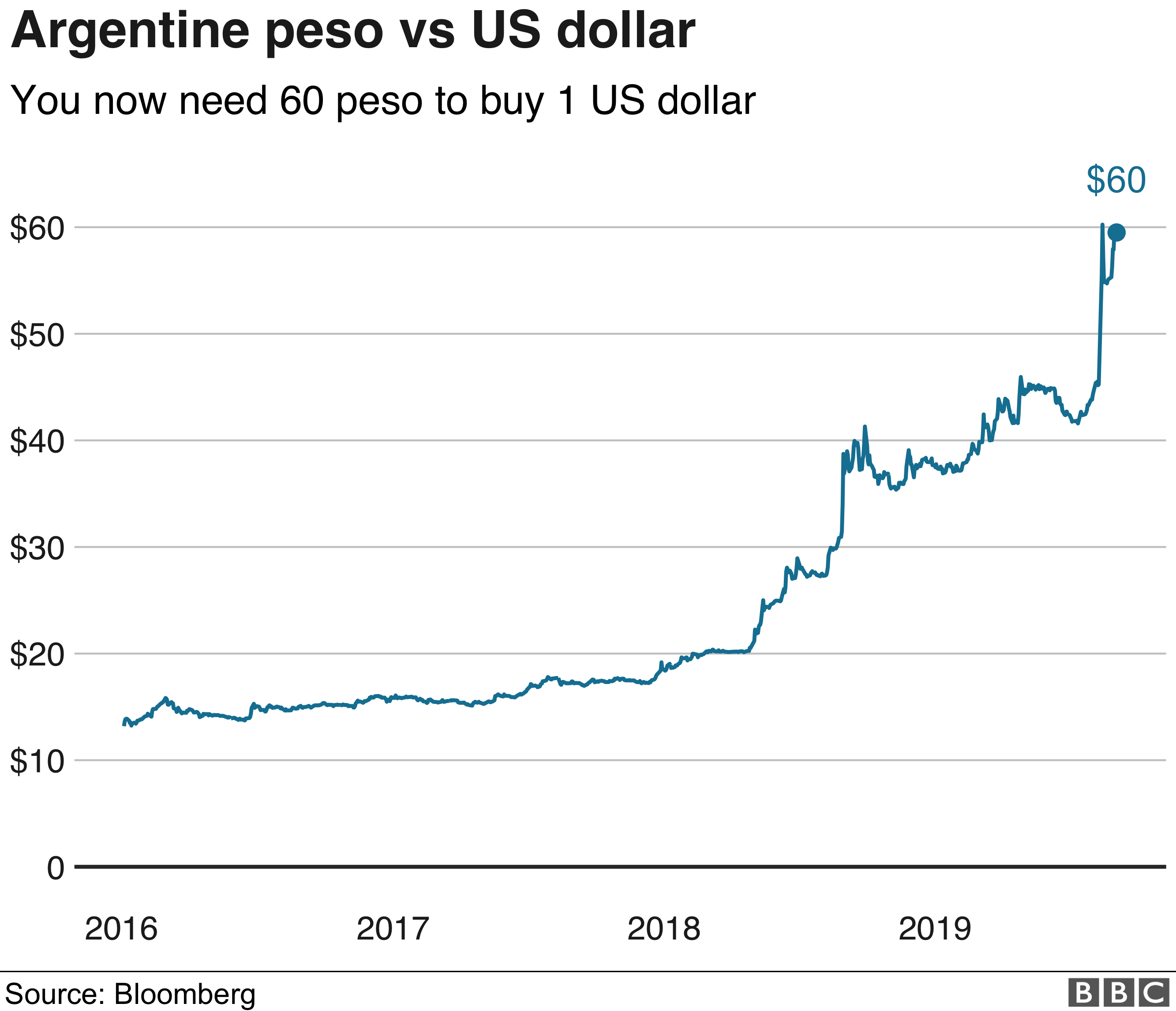

The peso fell to a record low last month after the vote showed that the business-friendly government of President Mauricio Macri is likely to be ousted in elections in October.

The country is in a deep recession. It has one of the world’s highest inflation rates, running at 22% during the first half of the year. Argentina’s economy contracted by 5.8% in the first quarter of 2019, after shrinking 2.5% last year. Three million people have fallen into poverty over the past year.

How is the move likely to be received?

Ordinary Argentines have traditionally had little faith in their own currency, preferring to convert their spare pesos into dollars as soon as they can. They don’t trust financial institutions much either, so they resort to what is locally known as the “colchón bank” – that is, stuffing their dollars under the mattress. Anecdotal stories abound of people keeping money buried in the garden, hidden in the walls or even stuffed in heating systems – occasionally with disastrous consequences if there is an unexpected cold snap.

People still have bad memories of the “corralito”, imposed in 2001, which stopped all withdrawals of dollars from bank accounts for a whole year. The only serious attempt to wean Argentines off their dollar dependency dates back to the 1990s under President Carlos Menem, when the peso’s value was fixed by law at parity with the dollar.

Last week, the country said it would seek to restructure its debt with the IMF by extending its maturity. This would give the country more time to pay back the money it owes to the IMF. Rating agencies, including Standard & Poor’s and Fitch, decided that amounted to a default and downgraded the country’s credit ratings. Whatever happens in Argentina, the risk of financial contagion is low, say analysts.