Excellent Podcast, an insight into trade thinking at the White House!

Category Archives: Tariffs

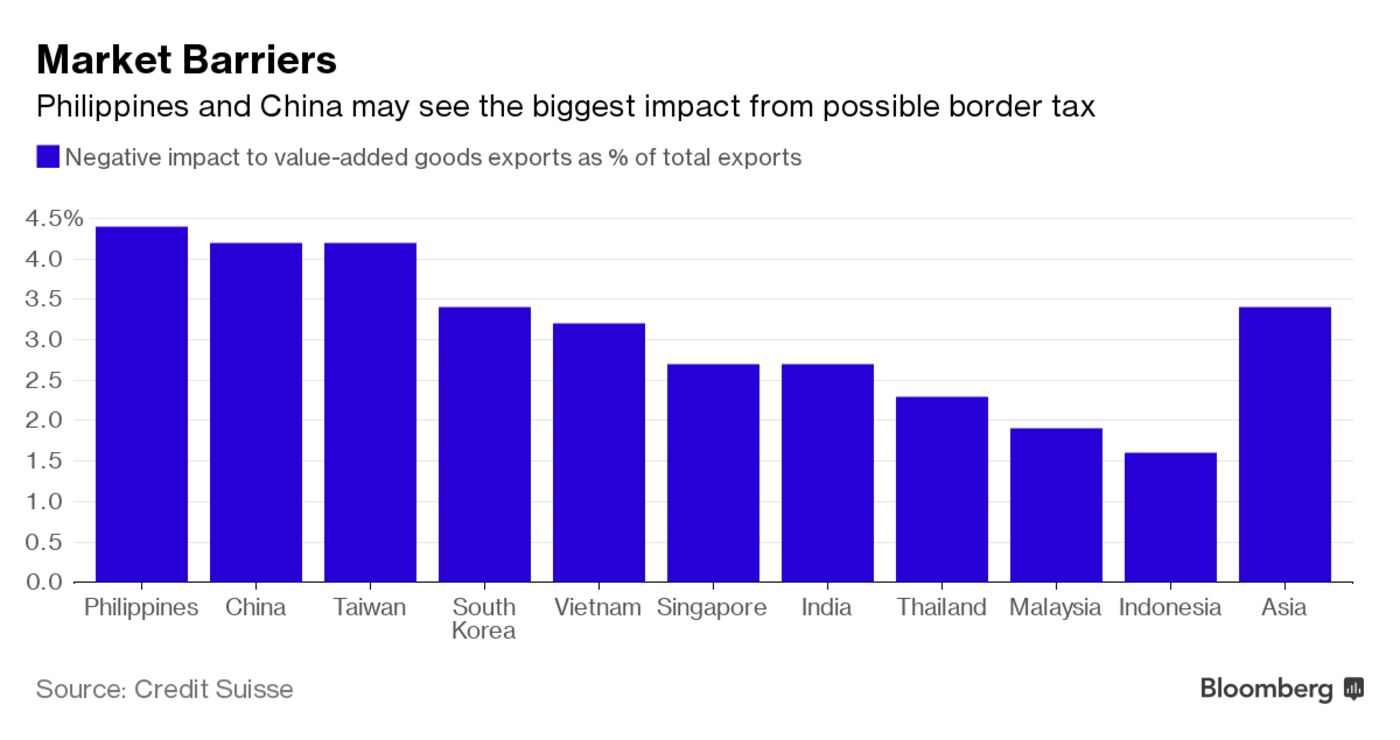

Tariffs on Gross Value vs Value Added Exports

The distinction between Gross Value trade balances and Value Added trade balances is crucial, not only to identify the true trade deficit between countries, but also to assess the impact of tariffs. Take the case of China/US imposing 25% tariffs on each others’ goods. While the dollar amount of traded goods covered by the tariffs is roughly the same (around $50 billion), the effects differ. Menzie Chinn points out that US exports to China are closer to 100% value added (when the entire product is produced with US goods and inputs). However, as noted in this post, roughly 50% of the value of US imports from China is foreign sourced. Taken literally, a 25% tariff the gross value of a Chinese export works out to be a 50% tariff on Chinese value added for Chinese exporters. Generally a tariff on gross value translates into a effective higher tariff for the country whose exports have the lower value added.

Trump Tariffs Vs Quotas

Episode 49 asks if “Trump’s Steel Quotas [are] Worse than His Steel Tariffs?Soumaya Keynes of The Economist and PIIE‘s Chad P. Bown describe how the Trump administration’s quotas imposed on steel imports from South Korea, Brazil and Argentina are different from the simple application of tariffs. They also speak with Jennifer Hillman – former administrator of US quotas for textiles and apparel in the 1990s – and Aaron Padilla (American Petroleum Institute) to explain the structure of Trump’s quotas, the perverse economic incentives and unintended consequences they create, and the new difficulties facing American businesses.

History Doesn’t Repeat Itself But It Often Rhymes…

… said Mark Twain. Here is a good rhyme: In 1930, 1,028 economists urged Congress to reject the protectionist Smoot-Hawley Tariff Act. And in 2018, over 1,100 economists warned Trump his trade views echo 1930s errors. So they simply copied-and-pasted the identical text that the 1,028 economists had sent as a depression warning in the 1930s. Congress did not take economists’ advice, the law passed in 1930 and was a key factor in a trade war that deepened the worldwide economic slump. Here is the full text of the 2018 letter

May 3, 2018

Open letter to President Trump and Congress:

In 1930, 1,028 economists urged Congress to reject the protectionist Smoot-Hawley Tariff Act. Today, Americans face a host of new protectionist activity, including threats to withdraw from trade agreements, misguided calls for new tariffs in response to trade imbalances, and the imposition of tariffs on washing machines, solar components, and even steel and aluminum used by U.S. manufacturers. Congress did not take economists’ advice in 1930, and Americans across the country paid the price. The undersigned economists and teachers of economics strongly urge you not to repeat that mistake. Much has changed since 1930 — for example, trade is now significantly more important to our economy — but the fundamental economic principles as explained at the time have not: [note — the following text is taken from the 1930 letter]

We are convinced that increased protective duties would be a mistake. They would operate, in general, to increase the prices which domestic consumers would have to pay. A higher level of protection would raise the cost of living and injure the great majority of our citizens. Few people could hope to gain from such a change. Construction, transportation and public utility workers, professional people and those employed in banks, hotels, newspaper offices, in the wholesale and retail trades, and scores of other occupations would clearly lose, since they produce no products which could be protected by tariff barriers. The vast majority of farmers, also, would lose through increased duties, and in a double fashion. First, as consumers they would have to pay still higher prices for the products, made of textiles, chemicals, iron, and steel, which they buy. Second, as producers, their ability to sell their products would be further restricted by barriers placed in the way of foreigners who wished to sell goods to us. Our export trade, in general, would suffer. Countries cannot permanently buy from us unless they are permitted to sell to us, and the more we restrict the importation of goods from them by means of ever higher tariffs the more we reduce the possibility of our exporting to them. Such action would inevitably provoke other countries to pay us back in kind by levying retaliatory duties against our goods. Finally, we would urge our Government to consider the bitterness which a policy of higher tariffs would inevitably inject into our international relations. A tariff war does not furnish good soil for the growth of world peace.

US-China-Tariff Part I: Opening Salvo

The WSJ reports that The White House is preparing to crack down on what it says “are improper Chinese trade practices” by making it significantly more difficult for Chinese firms to acquire advanced U.S. technology or invest in American companies. The pro business WSJ’s editorial board has has a different opinion. If there is a trade war, China will of course strike where it hurts most the first round of that conflict started after Trump imposed tariffs on washing machines (?) and solar panels.

1. Should the U.S. government impose tariffs on imported Chinese goods in

response to perceived improper trade practices by China? If so, on which goods?

2. Should the U.S. government use a “principle of reciprocity” in response to

perceived improper trade practices by China?

3. Beijing likely to retaliate against tariffs imposed by the U.S. on

imported Chinese goods? How would an anticipated retaliation affect the Trump

administration’s decision whether to impose tariffs?

Interesting is the assertion that the WTO dispute settlement mechanism is ineffective, given the actions of previous US presidents, and the fact that US insisted on the dispute settlement mechanism in the first place.

Steel V: Exemptions & Consulting Periods

Quick review, the top 10 Exporters of Steel to the US are

- Canada 16.7 percent

- Brazil 13.2 percent

- South Korea 9.7 percent

- Mexico 9.4 percent

- Russia 8.1 percent

- Turkey 5.6 percent

- Japan 4.9 percent

- Germany 3.7 percent

- Taiwan 3.2 percent

- China 2.9 percent

Canada and Mexico were exempt the day of the announcement, today a few more countries were also exempt: the entire European Union, Argentina, Australia, Brazil, and South Korea. Maybe the steel tariff was more about a detraction from other news than about steel?

Today Trump also announced a tariffs valued $60 billion on Chinese goods, but these will only take effect after a 60 day consultation period — to give industry lobbyists a chance to water down a proposed target list.

Steel Part IV: Why Steel?

Why Steel? Steel imports from China are not even in the top 10. The biggest steel exporter to the US: Canada, which was exempt from the tariff!?? So why did the administration pick steel as its opening tariff gambit to start a trade war? Here are the top 10 US steel producers:

Turns out Nucor provided Trump’s Trade guru Peter Navarro $1 million in hidden payments through a shell company to make a YouTube video about his book. And the other staunch steel tariff pusher in the cabinet, commerce secretary Ross owned International Steel Group Inc., which he sold for $4.5 billion. He remained on that company’s board until becoming commerce secretary in 2017…

Who wins and who looses under tariffs?

Self Initiated Trade Wars: Aluminum & National Security

Today the Commerce Department launched an antidumping case against Chinese aluminum imports. The reason: Aluminum is [supposed to be] crucial for national security. Well…

The New York Times clarifies: Aluminum production has been declining before Chinese Imports ever started. Why? Because electricity, a key input in the production of aluminium, is cheapest in Iceland. Also, only 10% of US aluminum imports come from China,

(source: US ALUMINUM ASSOCIATION)

Since electricity is expensive in the US, aluminum production plants plants that still operate in the US must be heavily subsidized (such as the NY Massena plant which receives subsidies to the tune of $73 million) or they are located near hydropower (as in Pacific Northwest, which used to supply about 40% of the nations aluminum) . Of note is that at its height, the aluminum industry employed only 1000 workers (to produce 40% of US aluminum!!) in the Pacific Northwest and now that computer server farms compete for hydroelectricity so that Alcoa, the main aluminum supplier is now moving production to Iceland.

How about National Security? The commerce department cites gives as its reason for the antidumping case a “Section 232 Investigation on the Effect of Imports of Aluminum on U.S. National Security.” It turns out that there is only 1 plant in the US producing aluminum for the US military… which produces 5% of US aluminum

Well, producers will be ecstatic, while Forbes Magazine notes that producers can then raise the prices they charge to those American consumers. That being the very damage that such tariffs do to consumer interests. What we end up with is a transfer of money from consumers to domestic producers, exactly the reason why domestic producers so like such tariffs.

Some of this is just straight textbook international trade. The politics are confusing, however, given that Trump proclaimed just a couple of weeks ago that “he does not blame China for the “unfair” trade relationship between the countries, despite long railing against the economic imbalance. He gave China “credit” for working to benefit its citizens by taking advantage of the US.” (BBC)

Finally, in a twist that comes across stranger than fiction, the Commerce Department is “self initiating” the antidumping investigation. Generally US administrations respond to requests by the industry or labor to investigate trade related matters, but every now and then presidents become eager to make their points without a mention that the industry has been injured. This is historic, the last time this happened was under President Bush (Sr) 25 years ago.

Strategic Trade Policy – Not So Strategic

Donald Trump has made it clear that he wants to put “America First” according to Steve Bannon’s philosophy of “economic nationalism.” The devil turns out to be in the detail: “How” to put America first?

One approach is to slap trade barriers on the competition. Boeing recently rejoiced when the administration imposed a 300% tariff on Canadian Bombarier’s planes. Interestingly, Bombardier was making small planes of the type that Boeing does not even produce — so the competition argument for protection was a fictitious red herring (Boeing’s single-aisle 737 plane is not a direct competitor). Also, the “America First” mantra quickly questioned by US airlines, which complained that such a tariff was preposterous since they could not by similar planes on the US market. Delta Airlines was stunned as it had just agreed to purchase a lot of Bombardier planes whose price had just tripped.

The Delta CEO thought the tariff in front of Bombariers bow would just be the opening gambit and stated that “we don’t believe that will be the end of the story.” He was right, it was not. It came even worse US economic nationalists: instead of selling only a few planes globally, as planned, Bombardier folded, sold its blueprints to Airbus, which will now be producing 1000s of Bombardiers planes globally, some in the US to sell to the US market. Was Boeing/Trump really expecting the global economy would take their affront and roll over? The law of unintended consequences struck again, as it usually does when mindless, quick solutions to thorny competitiveness problems create nothing but problems.

Border Tax & Other Veiled Tariff Mechanics

Tariffs and Export Subsidies are blatant violations of WTO rules. The new new thing in protectionism is the “Border Adjustment Tax.” Congress and President Trump are preparing their own versions, but here is a nice description of this veiled tariff:

“Essentially, companies would be able to deduct from their U.S. Federal tax filings the cost of goods and wages produced in the U.S. and exclude any revenue from exports. To illustrate Company A is a retailer who buys its products from China (think Walmart). Lets say it has $1 billion in revenue and spends $100 million on its stores and employees and $800 million on imported goods. The resulting profit of $100 million would be taxed at 35%, producing a $65 million after tax net profit. Under a border adjustment tax it still produces a $100 million profit before taxes but now it’s tax profit is considered to be $900 million ($100 million real profit plus $800 million in non deductible imports). The FIT would now be $315 million (35% of $900 million) producing a net loss of $215 million. To keep producing a 10% after tax profit Company A now has to increase its prices about 25%.

Now Company B is an export driven company (think Boeing). It produces $1 billion in revenue like Company A but 80% of it’s sales are exported with its costs in the U.S. being $900 million producing a $100 million dollar profit before tax and $65 million after tax. For tax purposes they only have to declare $200 million in U.S. sales (the $800 million in exports is not considered revenue for tax purposes). Under the new approach Company B would declare $200 million in revenue and $900 million in expenses for a tax loss of $700 million with a tax refund of about $250 million bringing their after tax income to $350 million ( $100 million normal profit plus a tax refund of $250 million).”

Note that, while companies would no longer be able to deduct the cost of their imported goods, and the sales of their exports would no longer be subject to U.S. taxes. That means American companies could reduce the prices for products they sell abroad, a simply veiled export subsidy.

Oh Boy, so much for Republicans simplifying the tax system. This is rife for transfer pricing games. The tax is supposed to raise about $100 billion/year, to offset the $500 billion hole created by the proposed reduction in the corporate income tax from 35% to 10%.  More wonkish info available here

More wonkish info available here

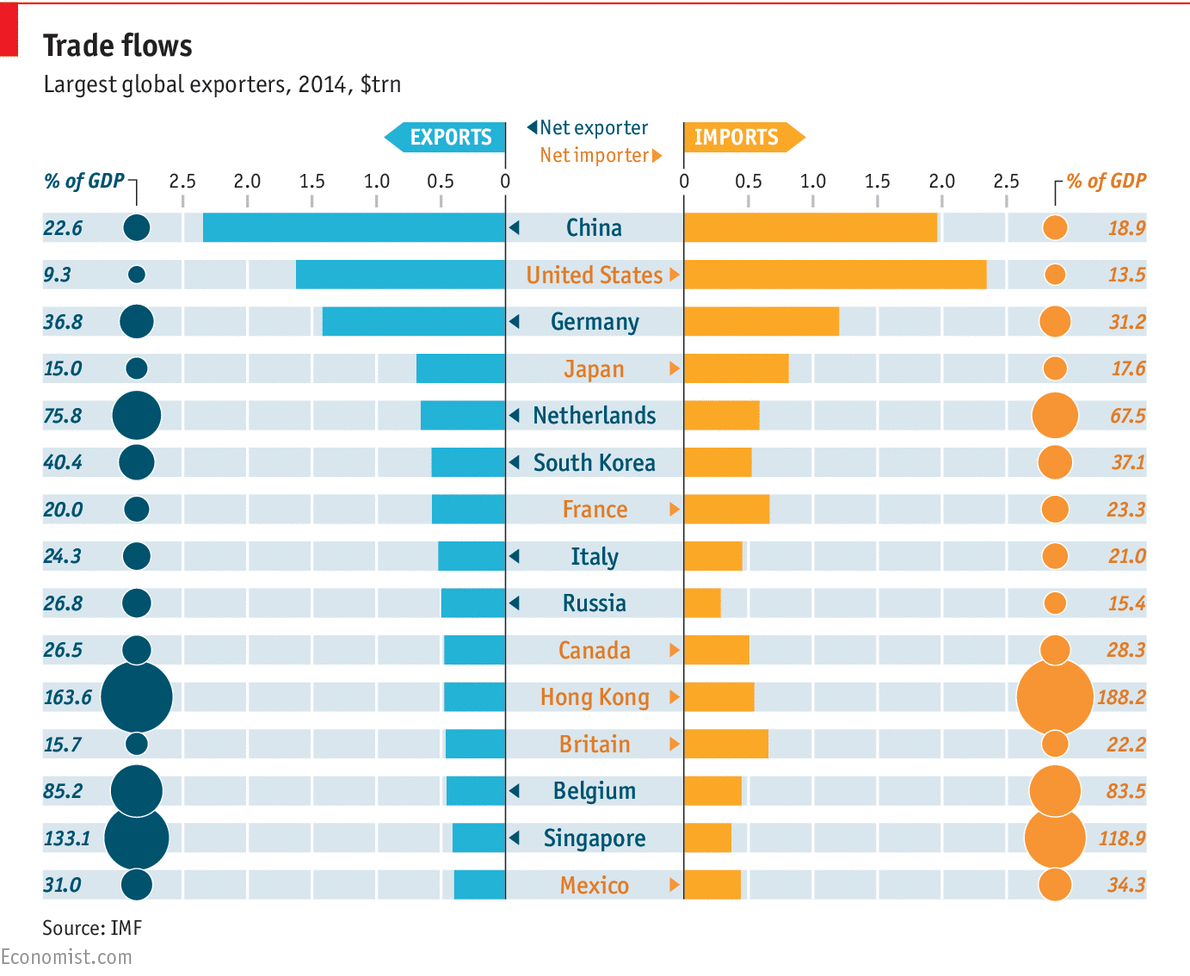

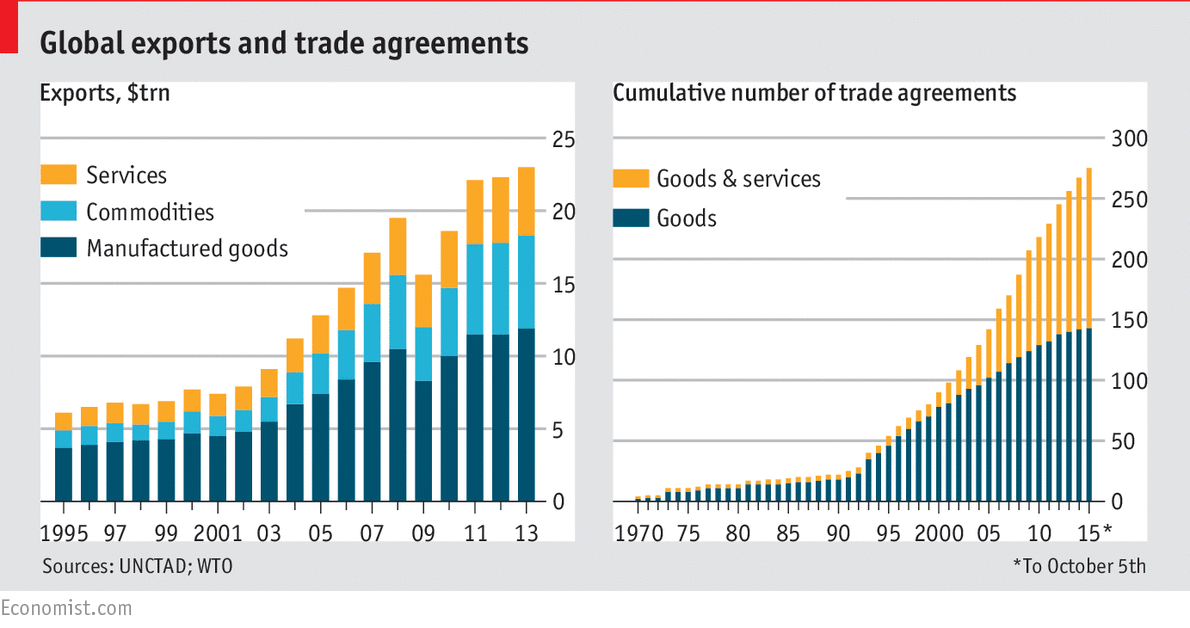

There is Rhetoric and there is Data

The Economist Magazine asks: Why everyone is so keen to agree new trade deals?

The Lollipop War

The Lollipop war goes back to 1789! But it did not start in earnest until the great depression. Here is the most recent installment (mp3 and transcript):

Mercantilism in a Large Open Economy

Dani Rodrik expounds the virtues and pitfalls of the Chinese exchange rate manipulation. For a change, he does not focus on US-Chinese economics, but on the impact of the undervalued Yuan on poor countries.

a) use the large open economy diagram to show how the absence of FX intervention no the part of the Chinese Central Bank, and the associated one-time depreciation of the Chinese yuan, would affect China and poor countries

b) explain why the artificially weak Yuan is equivalent to Mercantilism or Neo-Mercantilism.

c) If China implements high tariffs on imported goods, do you think that its propensity to import is big or small?

d) What would such a tariff mean for output in poor countries that reply on China as a trading partner?and How does this relate to Rodrik's point abou the poor countries' core problem?

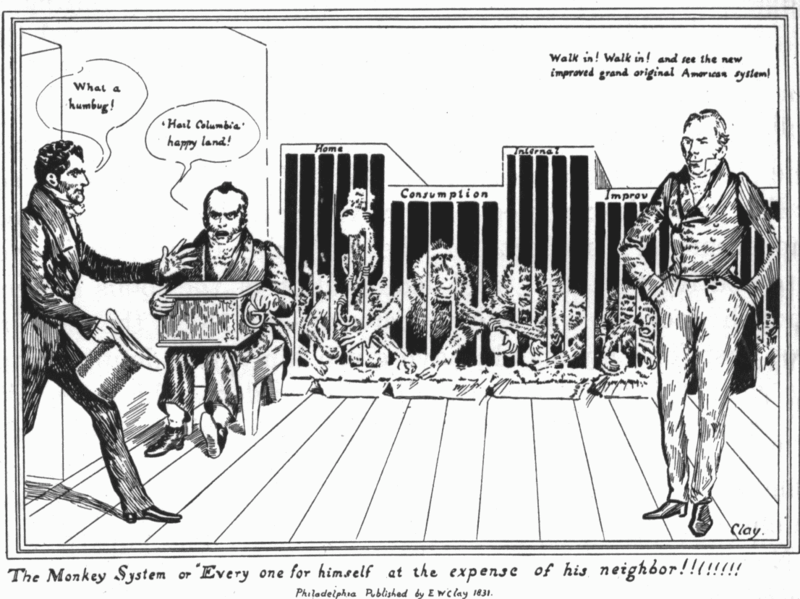

It turns out the US has its own history of trade manipulation. Cartoonist E.W. Clay published the below cartoon in 1831 to lampoon the "American System" of Protection as a "Monkey System" where "Every one for himself at the expense of his neighbor!"

(Source)

The “American System,” was the first US government-sponsored attempt to invigorate

the national economy through trade manipulation. It implemented Alexander Hamilton’s ideas, as outlined in his 1792 “Report on Manufacturers.” At the time he proposed a protective tariff of 20-25 percent on imported goods – such as woolens, cottons, leather, fur,

hats, paper, sugar and candy, to protect the nation’s fledgling

industries from foreign competition. Congress finally passed the tariff in 1816.

Japan as Number 3

In 1979, Professor Vogel shocked the world with the bold title of his book:

It was a shock, because Japan was exporting cars like this at the time:

A few years later, the Japanese car makers brought US car makers to their knees – to the degree that Chrysler received its first government bailout in the early 1980s. When the US car industry was threatened by the popularity of cheaper more fuel efficient Japanese cars, the US government threatened car tariffs in 1981. As Japanese manufacturing productivity exploded across all manufacturing sectors, so did its exports, and soon Ezra Vogel's book became the book to read in the 1980s.

Alas, Japan never became number 1 – and just a few days ago it lost its number 2 status, as China advanced to become the second largest global economy. The Economist points out, however, that the Chinese rise is less about China than about the Japanese decline:

WHEN China's economy was announced as the world's second-largest earlier this week, the news was spun as a China story, or occasionally as a story about the Chinese challenge to America. But the data that triggered the announcement were Japanese, and China's rapid catch-up to the Japan says as much about the latter economy as the former.

Five years ago China’s economy was half as big as Japan’s. This year it will probably be bigger (see chart 1). Quarterly figures announced this week showed that China had overtaken its ancient rival. It had previously done so only in the quarter before Christmas, when Chinese GDP is always seasonally high. Since China’s population is ten times greater than Japan’s, this moment always seemed destined to arrive. But it is surprising how quickly it came. For Japan, which only two decades ago aspired to be number one, the slip to third place is a gloomy milestone. Yet worse may follow. Many of the features of Japanese capitalism that contributed to its long malaise still persist: the country is lucky if its economy grows by 1% a year. Although Japan has made substantial reforms in corporate governance, financial openness and deregulation, they are far from enough. Unless dramatic changes take place, Japan may suffer a third lost decade.

Read the entire piece. It's largely about the structural problems in the Japanese economy, and especially in Japan's corporate sector. But one shouldn't overlook the chilling effect of years of deflation.

Sweet Deal

![[SUGAR_p1]](http://sg.wsj.net/public/resources/images/P1-AU269A_SUGAR_NS_20100314194814.gif)

The 105.4 % U.S. Chicken Tariff

Chicken-Tariffs Turn into a Saga. First Russia attacked Bush Legs, now China is taking on Tyson (and that's not Mike Tyson).