Here goes another currency. Let's examine the anatomy of the crisis:

- Policy Change Aimed at Scaring Away RUB Sellers with Threat of Intervention

- Capital Controls Loom Ahead, Warning of Aggressive Volatility on the Horizon

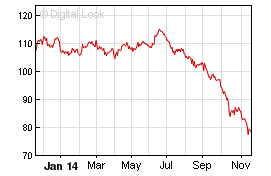

The Central Bank of Russia (CBR) abandoned the exchange-rate “corridor” containing the Ruble’s value against the Euro and the US Dollar, allowing the unit to float freely. The move marks the latest in policymakers’ attempts to deal with a precipitous drop in the currency that has thus far produced losses of as much as 47.8 percent this year against the greenback.

Why are there risks of more stringent capital controls and potentially significant trading losses on the horizon?

Markets Send Russian Ruble Sharply Lower on Political Turmoil

The Ruble started what would evolve into a near-parabolic plunge in mid-July following the downing of Malaysia Airlines flight MH17 over the Ukraine. The incident marked an escalation of tensions between Moscow and Western powers that began as the toppling of Ukraine’s government amid mass protests early in the year led to the secession of Crimea and its subsequent Russian annexation. The US and the EU unveiled a new round of anti-Russian sanctions by the end of the month.

Geopolitical Risks Spark Capital Flight out of Russia

Source: Bloomberg

Investors spooked by swelling geopolitical risk began pulling money out of Russia, sending the capital account to lows unseen since 2009 and helping to push the Ruble to record lows against the Euro as well as the US Dollar. Selling pressure was compounded by a sharp reversal in crude oil prices. Energy sales account for close to two-thirds of Russian exports and a deteriorating outlook on that front helped encourage liquidation across the spectrum of assets sensitive to the country’s economic fortunes.

Noteworthy Declines in Crude Oil Prices Worsen Pressure on Russian Ruble

Source: Bloomberg

The dual headwinds of sanctions and a dimming exports outlook coupled with the sinking currency made for a toxic mix. A survey of analysts polled by Bloomberg reveals increasingly acute “stagflation” expectations as median forecasts for 2015 economic growth and inflation race in opposite directions. This has put the central bank squarely between the proverbial “rock and a hard place”. On one hand, soaring price growth demands tightening; on the other, fading output expansion begs for easing.

Russian Central Bank Put in Difficult Position as Raising Interest Rates Difficult, Ineffective

Faced with this dilemma, policy officials set about attempting to stem the currency’s slide in an apparent bid to calm the waters before tackling larger issues. Trying to discourage sellers with aggressive interest rate hikes as well as directly fighting the drop by selling FX reserves in exchange for the local unit have proven futile. This has left the central bank with a hard choice: allow the Ruble selloff to run its course or introduce a far more draconian regime of restrictions to squash capital flight.

Bank of Russia Floats Exchange Rate to Stem Ruble’s Decline – Effectiveness Unclear

The Bank of Russia unexpectedly floated its exchange rate in an attempt to control the currency’s freefall, and thus far it looks like a risky move. Allowing the Ruble to run its course and raise the risks of outright intervention in FX markets, and the threat of unpredictable RUB selling makes it far less attractive to sell into the currency’s declines. The Russian Ruble rallied sharply on the CBR’s actions, but the early victory is hardly encouraging.

As history amply demonstrates, the threat of big-splash intervention and even its repeated realization has failed to sustainably deflect investors’ assault on a given currency. One need only look at Japan and New Zealand’s recent attempts at bullying the markets to see how quickly their impact evaporates as traders shake off losses and return to the offensive.

Major Risk to Investors as Continued Ruble Losses Invite More Drastic Action

The punchline is clear: further Ruble declines and broader financial market volatility would force the Bank of Russia into even more drastic measures and threaten real monetary harm to investors. What was arguably unthinkable three months ago is now a distinct possibility: the CBR could halt all speculation and cross-currency investments with the Ruble and force substantial losses on investors and savers.

Sophisticated investors are likely among the first to abandon a given market on the first sign of danger. But the risk is clear – what if this sparks a broader run on the Russian banking system?

Volatility Prices and Realized Volatility on US Dollar/Russian Ruble at Highest since Financial Crisis

Russian Financial Crisis of 1998 Offers Clear Warnings

The Russian Financial Crisis of 1998 underlines the potentially substantial effects of further turmoil and risks to the investor. Given a toxic mix of risks to the economy, the Russian government devalued the Ruble, defaulted on domestic debt, and in effect defaulted on payments to foreign creditors. The results were dramatic: the exchange rate plummeted and domestic inflation hit 84 percent as a veritable run on the Russian financial system sent domestic savers and investors scrambling for “hard” currencies. The ensuing political fallout brought now-Russian President Vladimir Putin into power.

Vladimir Putin knows the risks of political regime change are significant, and we would argue he could take even more significant measures to prevent this much.

Capital Controls – Why should Investors Worry?

Putin’s government could in effect subject financial markets to far more stringent controls than in 1998 and for most intents isolate Russia from world financial markets. If a trader is holding a position in theUSD/RUB or any other RUB-based pair, this could mean that trades would be closed at a significantly unfavorable rate—likely causing losses for those on either side of the trade.

Much of this is clearly speculation, and it is impossible to know exactly what the outcome will be. Yet the real takeaway is also sobering: further turmoil makes what was once seen as an insignificant possibility to a real probability. Putin’s actions to date increasingly hint at a policy of outright isolation from the West and even global capital markets.

Even non-Ruble traders should take note; Russia is far from an economic backwater. Its financial links around the world have clearly shrunken in recent months due to sanctions and the flight of capital, but a true rupture of these connections may trigger violent gyrations across the asset spectrum as investors scramble to adjust portfolios.

![[ABREAST]](http://sg.wsj.net/public/resources/images/MI-BD080_ABREAS_NS_20100502191214.gif)

![[SPAIN_p1]](http://sg.wsj.net/public/resources/images/P1-AT968_SPAIN__NS_20100224184413.gif)