The US treasury will be financing an epic fiscal deficit of about $1.8 trillion in 2009. The large fiscal deficit has cause a slight panic in some circles that the US may not be able to raise all this money (which would lead to higher interest rates). Perhaps.

Brad Sester provides an insightful discussion based on the national income and national savings identities discussed in Chapter 14 (the derivation of eq. 14.1a). His point is that if you use the relationship between the trade balance (TB) and the national savings gap (SN-1), it becomes apparent that the US as a whole is actually borrowing a lot less than in the past:

The United States is borrowing less from the rest of the world than it was. That is true even though the US Treasury is borrowing more from everyone, including more from the rest of the world. The amount the US borrows from the world is the gap between the amount that Americans save and the amount that Americans invest at home. That turns out to be equal to the current account deficit. And for the US, it so happens that the current account deficit is about equal to the (goods and services) trade deficit. The trade deficit — at least in the first quarter of 2009 — was way down. In dollar terms, it was about half as big as it was in the first quarter of 2008. That implies that the US is borrowing far less from the world now than at this time last year.

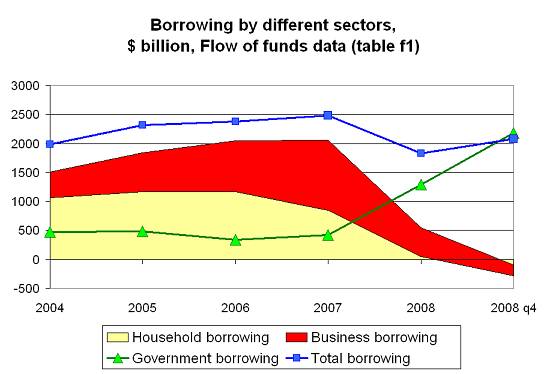

Why hasn’t the expansion of the fiscal deficit pushed the amount the US borrows from the world up? Simple. American households and businesses are borrowing a lot less, so the total amount of money that Americans are borrowing isn’t rising. A picture is generally more effective than words. The following chart shows borrowing by various sectors of the economy — households, firms and the government.** All data comes from the Fed’s flow of funds, table F1.

As the chartshows, the rise in government borrowing came even as other sectors of theeconomy were borrowing a lot less. Household borrowing peaked in 2006.Borrowing by firms actually peaked in 2007 — remember all the leveraged buyoutsthen. Borrowing by both households and firms fell precipitously in 2008. As aresult, total borrowing by households, firms and the government fell in 2008.