The East Grows only because the West Consumes. Bitch Please.

Danny Quah – 23rd October 2012

An abiding belief held by many about the global economy is that the East is one gigantic Foxconn-shaped, steroid-boosted manufacturing facility, pumping out iPhones, shoes, clothing, refrigerators, air-conditioners, and defective toys that its own people could never afford. In this narrative, the only reason that measured Eastern GDP shows any kind of life is because the Western consumer steps into the breach to buy up these manufactures.

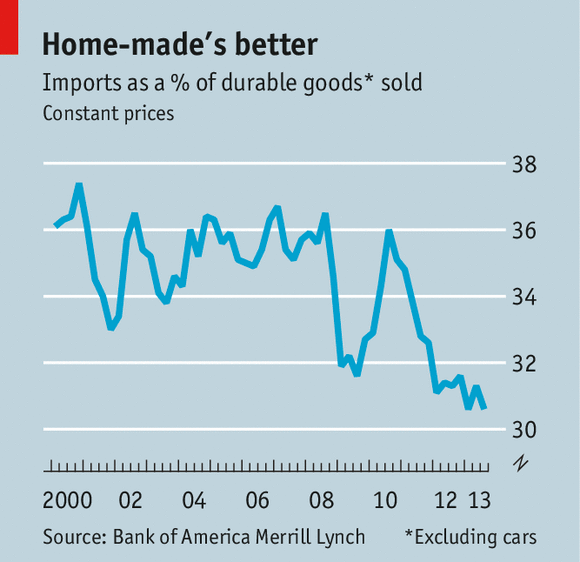

The confirming natural experiment would then be what was sure to occur post-2008, when Western imports collapsed. Here is what actually happened:

China became the single largest contributor to world economic growth, adding to the global economy 3 times what the US did. Since this chart shows GDP at market exchange rates, those who have long argued China’s RMB is undervalued must be standing up now to say that China’s real contribution is likely even larger. Sure, China undertook a massive fiscal expansion beginning November 2008. But, hey, everyone fiscal-expanded.

In number two position among the contributors to global growth is Japan. Yes, “Lost Decades” Japan helped stabilize the global economy more than did the US. Among the other top 10 contributors are the other BRIC economies, and Indonesia.

How is East Asian or emerging economy growth merely derivative when they had nothing among Western economies from which to derive?

Here’s the other interesting fact:

(German exports to the rest of the world. Source: IMF Direction of Trade Statistics, 2011)

This chart addresses the question: How has Germany remained a successful export-oriented growing economy when its domestic demand is weak, the Eurozone is buying hardly anything these days, and German exports to the US have collapsed in the wake of the 2008 Global Financial Crisis? The chart shows that today Germany exports 30% more to Developing Asia than it does to the US. And this is not just a China effect: German exports to China account for just two-thirds of exports to Developing Asia overall. Also notice how as late as 2005, German exports to the US were still double those to Developing Asia.

The East grows only because the West consumes. Bitch please.

1. Describe the

major thesis, the central idea, or set of ideas in

the reading.

2. Identify a

concept presented in the article, define or describe it, and compare or

contrast it to an idea that you have read about in any other article. Discuss

how they are similar or different, and how they are related to each other.

3. Write a one

paragraph critical perspective on some aspect of the

article, citing evidence that prompts you to agree or disagree with the

author’s perspective.