The BBC reports: “Theresa May has told leaders at the World Economic Forum in Davos that the UK will be a “world leader” on trade.” How does that work? UK becoming the world(?!) leader on trade when Britain just decided to leave the world largest trade zone? Who believes post-factual tales?

source

source

Category Archives: Brexit

MERCOSUR Telenovela

MERCOUR is the Latin American “NAFTA” or EU. Except its not really functioning… Here is the latest installment: While BREXIT is expected to take years, one MERCOSUR member was just summarily ejected… The article claims its because of democracy and human rights violations, but it turns out the reason is actually economic “Three years after joining Mercosur, Venezuela still has not met most of its obligations and accession commitments. The apparent reluctance to adapt to common standards strengthens the view that Caracas has always bet more on the South American bloc as a political platform than as an area of free movement of goods, services and people. Venezuela’s Treaty of Accession…,

Oups, What Now?

NPR reports that after the Brexit Vote, Britain Asks Google: ‘What Is The EU?’

By a 52-48 percent margin, the popular vote in the United Kingdom moved to detach the country from the European Union. It’s been a momentous event, building up for months with anticipation and anxiety domestically and abroad, marked by bitter campaigning, sharp regional disagreements and the murder of an anti-“Brexit” member of Parliament, Jo Cox. But if you judge a country’s interests only by prevalent Google searches, it was after the polls closed when British voters started to think seriously about the implications of their choice.

According to data from Google Trends, the searches for “what is the eu” and “what is brexit” started climbing across Britain late into the night. The polls closed at 10 p.m. local time. Searches for “what is the eu” and “what is brexit” spiked in the U.K. after polls closed. Though of course searches for these questions were dwarfed by the general interest in “Brexit results,” the question “what is the EU” spiked in popularity across all parts of the U.K., in this order: Northern Ireland, Wales, England, Scotland. Google Trends, on Twitter, has highlighted a few local spikes, too, with “what is Brexit” a top search related to the referendum in both Northern Ireland and Scotland. Both of them voted in favor of remaining in the EU. Londoners specifically did a lot of googling for “move to Gibraltar.” (Gibraltar is a British territory in southern Europe.)

Economic Effects of Brexit Forecasts

Economic Effects of Brexit Part I

Brexit is a political decision with economic consequences. The BBC outlines the immediate effects. Somewhat stunning in a world where data usually reports economic effects with significant lags, there seem to be strong indications of a sharp drop in the UK economy. Vox provides a forecast from some economists:

Here’s John Van Reenen, director of the Centre for Economic Performance at the London School of Economics: There will be an immediate slowdown of growth. At the moment, there’s still a ton of confusion as Britain’s government decides whether and how to actually exit the European Union. And that uncertainty alone could lead to economic turmoil. You get a rabbit-in-the-headlights phenomenon where businesses don’t want to make new decisions, or new investments, because they are uncertain about the future. The immediate effect will be a lowering of investment activity, a lowering of hiring. There will an immediate slowdown of growth.

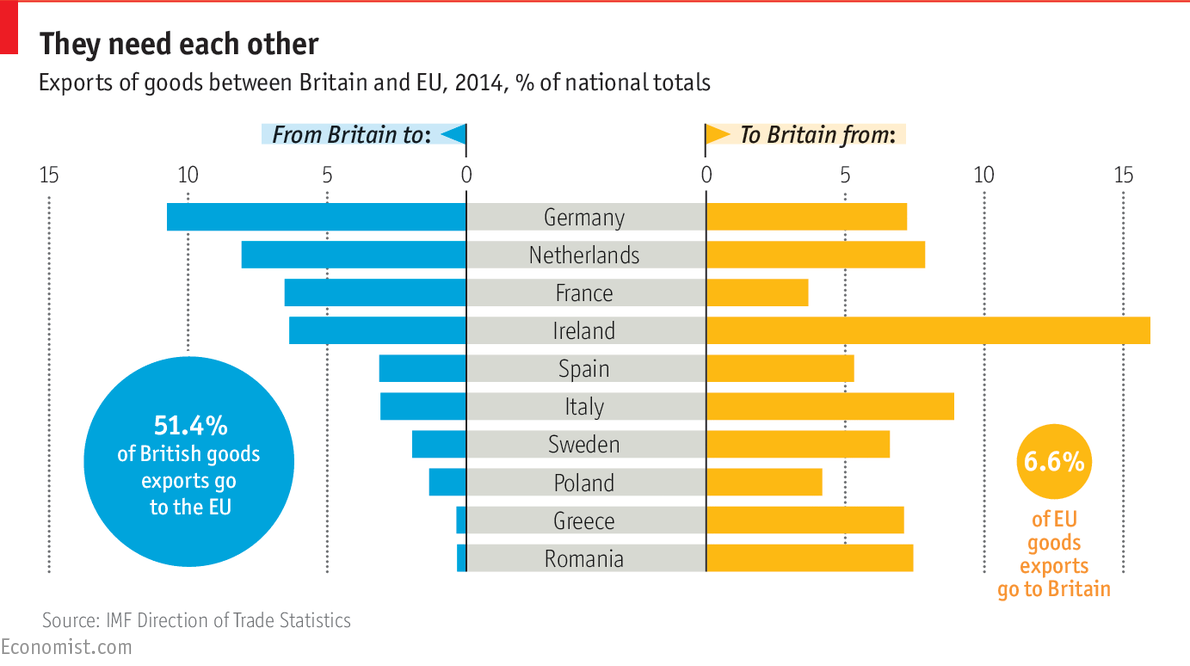

Prior to the referendum, the Centre for Economic Performance at the London School of Economics put out a research brief explaining why the British economy would suffer if it actually did leave the EU. Among other things, 48 percent of all UK exports go to the rest of Europe, and the country has long benefited from the lower tariffs and favorable market access that comes with EU membership. If Britain left, those trade flows could shrivel considerably — though there would be a two-year window in which the country will maintain unfettered market access as it negotiated an exit. The report notes that UK incomes could fall between 1.1 percent and 3.1 percent as a result. In the longer term, the slowdown in productivity growth and new restrictions on immigration could hurt Britain’s growth prospects even further, though that’s harder to quantify.

Paul Krugman of the New York Times argues that leaving the EU would hurt Britain’s economy… Yes, Brexit will make Britain poorer. It’s hard to put a number on the trade effects of leaving the EU, but it will be substantial. True, normal WTO tariffs (the tariffs members of the World Trade Organization, like Britain, the US, and the EU levy on each others’ exports) are low and other traditional restraints on trade relatively mild. But everything we’ve seen in both Europe and North America suggests that the assurance of market access has a big effect in encouraging long-term investments aimed at selling across borders; revoking that assurance will, over time, erode trade even if there isn’t any kind of trade war. And Britain will become less productive as a result.

But he’s also skeptical that Brexit would lead to a broader financial crisis the way, say, the implosion of Lehman Brothers in 2008 did: But right now all the talk is about financial repercussions – plunging markets, recession in Britain and maybe around the world, and so on. I still don’t see it. It’s true that the pound has fallen by a lot compared with normal daily fluctuations. But for those of us who cut our teeth on emerging-market crises, the fall isn’t that big – in fact, it’s not that big compared with British historical episodes. The pound fell by a third during the 70s crisis; it fell by a quarter during Britain’s exit from the Exchange Rate Mechanism in 1992; it’s down about 8 percent as I write this. …. Furthermore, Britain is a nation that borrows in its own currency, not subject to a classic balance-sheet crisis due to currency devaluation – that is, it’s not like Argentina, where the fall in the peso wreaked havoc with firms and consumers who had borrowed in dollars.

If you were worried that fears about Brexit would cause capital flight and drive up interest rates, well, no sign of that – if anything the opposite. Before the vote, analysts at the Dutch bank ING tried to run numbers on the consequences of Britain leaving. One thing that makes this so maddeningly difficult is that there’s no real historical precedent: Quantifying the impact from a possible Brexit is anything but easy. As so often in these unprecedented big bang events, headline estimates of a quantified economic impact on the Eurozone and individual countries should be taken with a pinch of salt. … Nevertheless, such estimates give at least some idea of the possible magnitude. To give an example, a study by the German Bertelsmann Foundation, relying on Ifo estimates, shows that a Brexit could lower Eurozone GDP growth by between 0.01 and 0.03 percentage points each year.

ING also dug into some of the details, noting that European financial firms with offices in London could leave and relocate to the continent. (The financial sector is about 8 percent of Britain’s GDP, so that could make a considerable dent.)

Larry Summers, former director of the US National Economic Council, argues that it may take awhile to understand the full economic impacts; the biggest question is what happens if other countries in the European Union also decide to leave: For Britain, the economic effects are two sided. On the one hand, a major jolt has been delivered to confidence, to future unity and down the road to trade. On the other, the currency has become more competitive, and liquidity will be in very ample supply. I would expect that a significant deterioration in growth and a recession beginning in the next 12 months has to be a substantial risk though short of an odds on bet.

Brexit Defined

A nice summary from the BBC, make sure to read the entire link it covers just about every facet of Brexit. Here their exit graphic: