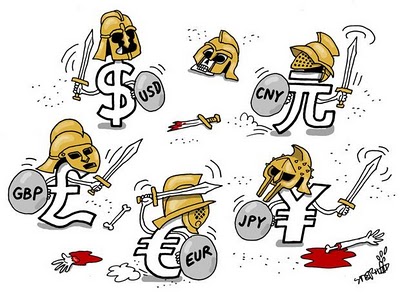

The term "competitive devaluations" or "beggar-thy-neighbor" policies refer to monetary policy designed to lower the exchange rate to increase exports and growth (see IE CH 19). More recently these policies have also been referred to as "currency wars" and even financial "weapons of mass destruction." A recent working paper by the World Bank now equates failures of the gold standard in the 1930s to competitive devaluations. Instead of unilateral devaluations, the World Bank document suggests

The optimal policy response to the Great Depression, in this view, should have been a coordinated, unsterilized devaluation against gold by all countries suffering deflation. In effect, this would have been a coordinated global monetary easing, but without the beggar-thy-neighbor effects on trade.

– How would "coordinated devaluations" across countries have avoided the beggar-thy-neighbor effects

– Can you see any problems with the World Bank's policy prescription?