Crude trade measures are tariffs, that are clearly observed and easiest to administer.

Then come quotas, whose implied tariff equivalent is not always easy to calculate in the real world, but quotas are still in-your-face trade restrictions that are easily picked up by the World Trade Organization.

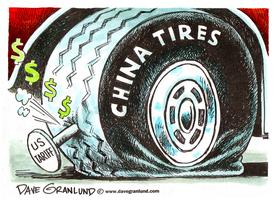

By the 1970s non-tariff barriers became the trade restriction of choice, the most promising of which are anti dumping measures and countervailing duties. Simply accusing foreign steel exporters to swamp the US market with low priced steel could deliver protection. Technically, dumping occurs only if the foreign producer sells below cost and engages in predatory pricing – but what are the foreign firm's costs, how can they be measured? Since these costs are often difficult to determine, governments often started to impose tariffs (see the 2002 US Steel Tariff) to counter supposed dumping – and then wait years for the WTO to sort out whether dumping actually occurred.

The new non-tariff barriers that are in vogue, involve "regulations". Staiger and Sykes provide a graduate level analysis, although the intro is informative. The most prominent example of such regulations is – you guessed it – China. The Chinese government recently introduced a new procurement measure which would give priority preference to products deemed to meet “indigenous innovation accreditation criteria", creating serious market access barriers to a large portion of the China market for foreign firms. Here is the US chamber of commerce news release. Here is the US Information Technology Sector's lobbying piece on the topic.

Students with a background in open economy macro will appreciate Dani Rodrik's point that China's WTO accession has tied China's hands and it is left with only one effective measure to fuel its export led growth: undervaluing its currency

1) outline the Chinese policy options to fuel economic growth – use the TB/Y diagram, or the MF model

2) Show how an appreciation would affect the Chinese economy

.png)