The recent years have been a frustration for anyone trying to make sense of China’s capital control policies. Capital controls have been an important part the Chinese economic policies since the communist revolution in 1949. At present, the dominant view both among Chinese policy makers and analysts is that at some point the restrictions have to go. They are incompatible with the pursuit of a

free market economy especially for a country with a leadership role in international commerce.

However, as with many other reforms, the chosen model of capital account liberalization has been baby steps. So far, capital account liberalization measures have opened up only new channel for Chinese firms to transfer funds abroad or new channels for foreigners to invest in China. Hong Kong has emerged as a renminbi (RMB) hub, where off-shore Euro-RMB can be deposited and freely traded. After all these developments, are the controls still effective?

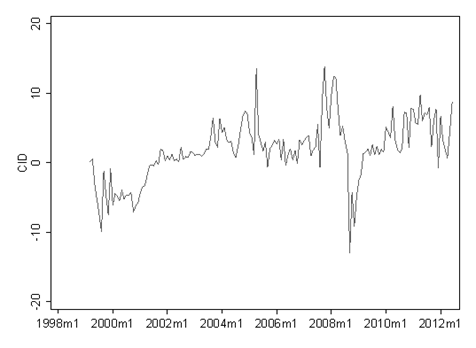

Yin-Wong Cheung and Risto Heralla study the covered interest differential (CID) between onshore and offshore RMB (interest rates on RMB assets in China and outside China). The CID is a much used measure of the effectiveness of capital account restrictions because it vanishes by arbitrage under free capital mobility. So, if the CID is still large (in absolute value), we can be confident that capital account restrictions are still important (“binding”), and the arbitrageurs have not yet been able to arbitrage away the interest differential. Cheung and Heralla find that Chinese Capital Controls are still binding (see graph below) in fact the CID seems to be getting larger over time..

Apparently, China still considers capital control policy to be an indispensable tool to manage and stabilize the economy. However, the use of capital controls to restrict capital inflows and thereby undervalue the RMB comes at high cost: it is at variance with the goal to develop the domestic economy, since it depresses credit

availability within China.