This post is not about the Gulf of Mexico. Calculated Risk alerts us the the Euro crisis is far from over. Something seems to be brewing in the financial markets… Quote of the day via Bloomberg (ht Bob_in_MA):

We do believe the recovery is strong,” Dominique Strauss-Kahn said in an interview with Bloomberg HT television in Istanbul. While rising debt levels are a risk to growth, mainly in Europe, authorities in the region “are now really committed to solve it” and “the problem has been contained,” he said.

And this reminds us of Fed Chairman Bernanke's testimony on March 28, 2007:

"[T]he impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained."

Uh oh, not another problem "contained"! This just in from the Atlanta Fed:

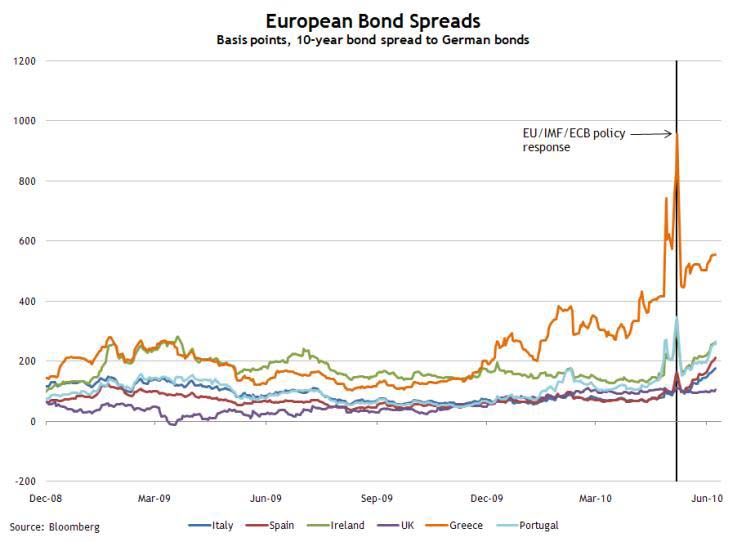

Following a decline after the initial reports of the EU/IMF €750 billion package and ECB bond purchases, peripheral euro area bond spreads (over German bonds) have widened. In particular, the bond spreads for Italy and Spain have widened the most relative to their levels before the rescue package was unveiled.

After initially declining four weeks ago, sovereign debt spreads have begun widening for peripheral euro area countries. As of June 9, the 10-year bond spread stands at 554 basis points (bps) for Greece, 258 bps for Ireland, 265 bps for Portugal, and 211 bps for Spain.

The spread to Italian bonds has increased 76 bps since May 11, from 1% to 1.75%, while Portuguese bond spreads are 112 bps higher during the same period. U.K. bond spreads are essentially unchanged.