One line of reasoning holds that Fannie Mae and Freddie Mac – the two quasi governmental agencies that are now in receivership and fully owned by the tax payer – caused the housing bubble. It took until now to inform this discussion with actual data. The NYT has the abstract and the entire report can be found here.

Interestingly, the Federal Housing Finance Agency suggests Fannie and Freddie did not cause the housing bubble, since one can think of the money that poured into the housing market as cash that was piled on on top of Fannie and Freddie's regular annual mortgage financing (in blue below). This reduced Fannie and Freddie's share of the US housing finance by about 50% in 4 years.

Source: Inside Mortgage Finance

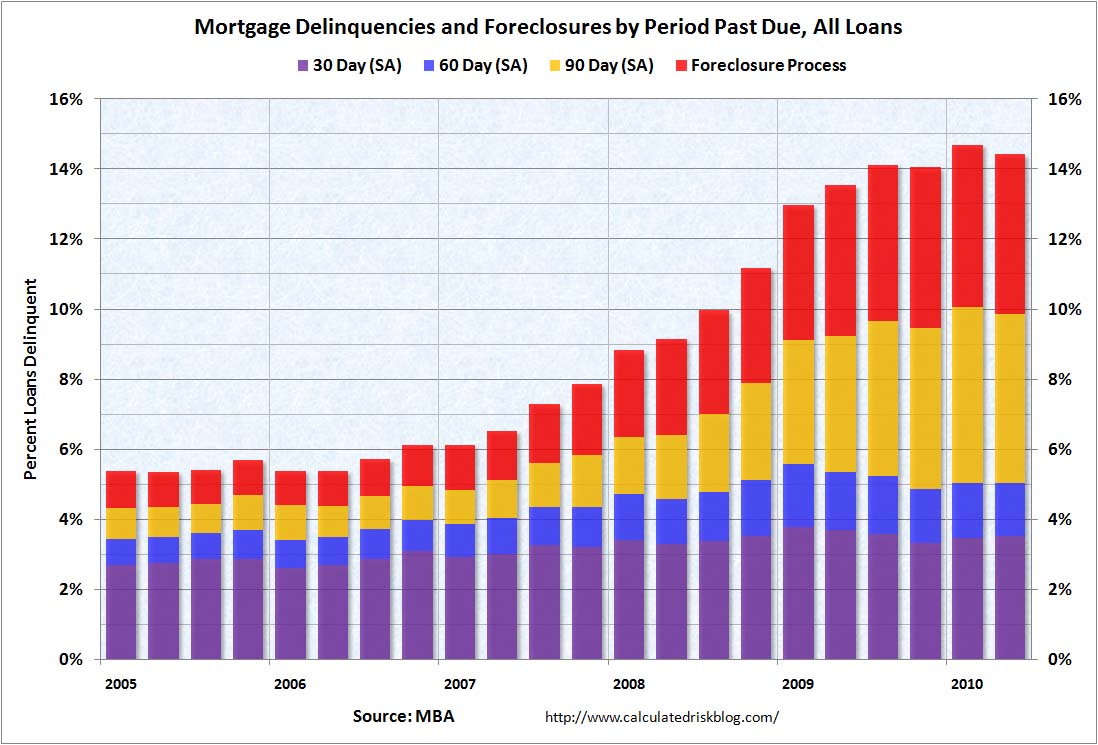

Right now it seems pointless to assign blame, the housing market is getting downright scary. New mortgage delinquencies are still increasing in the US and the decline in overall delinquency (still near all time highs) came only because of some loan modifications that targeted 90+ day delinquent loans.

See Calculated Risk Post: MBA Q2 2010: 14.42% of Mortgage Loans Delinquent or in Foreclosure

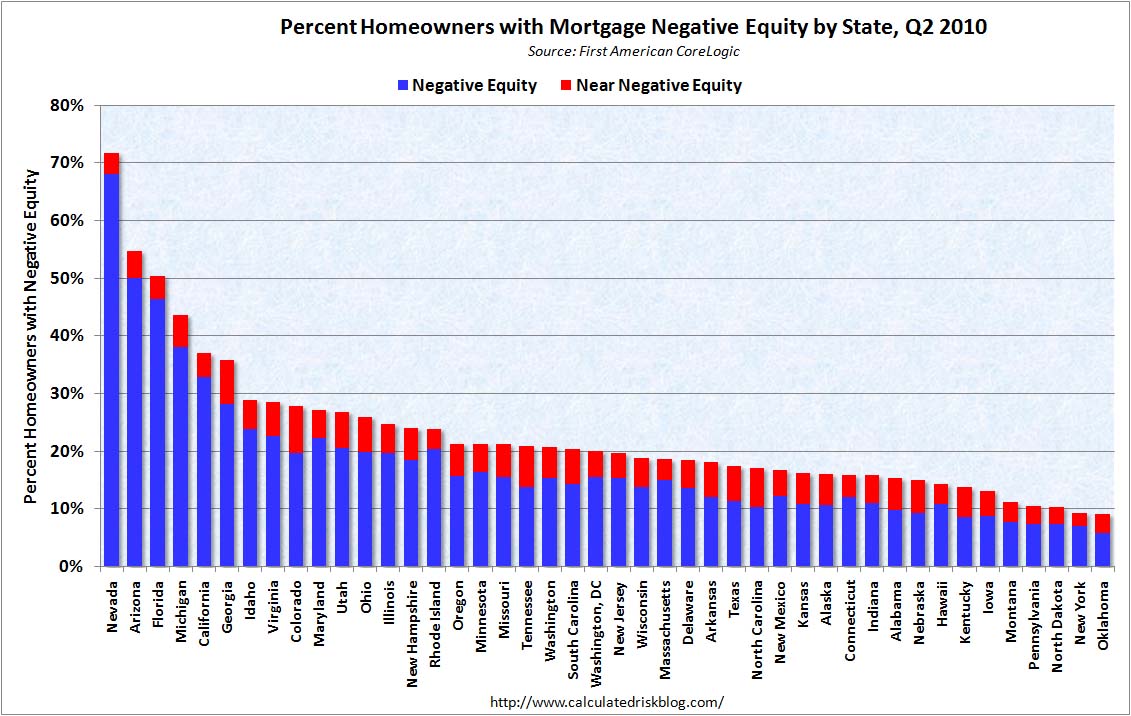

These delinquencies are partly explained by the high unemployment, but also by the negative equity that so many Americans now hold:

My plumber in Seattle (making $90/hour) proudly told he stopped paying his mortgage, since he is 20% under water. Scarily, the above chart suggests this level of negative equity is about average for the state.