A few days later, the ship’s owners apparently decided that the tariffs are here to stay, and (given the transportation costs of moving to an alternative market) there is not a higher net price to be obtained (more, here).

I) Cars and Motorbike Victims, with the three US major automakers recently warning that changes to trade policies are hurting performance due to higher steel and aluminium prices caused by new US tariffs.

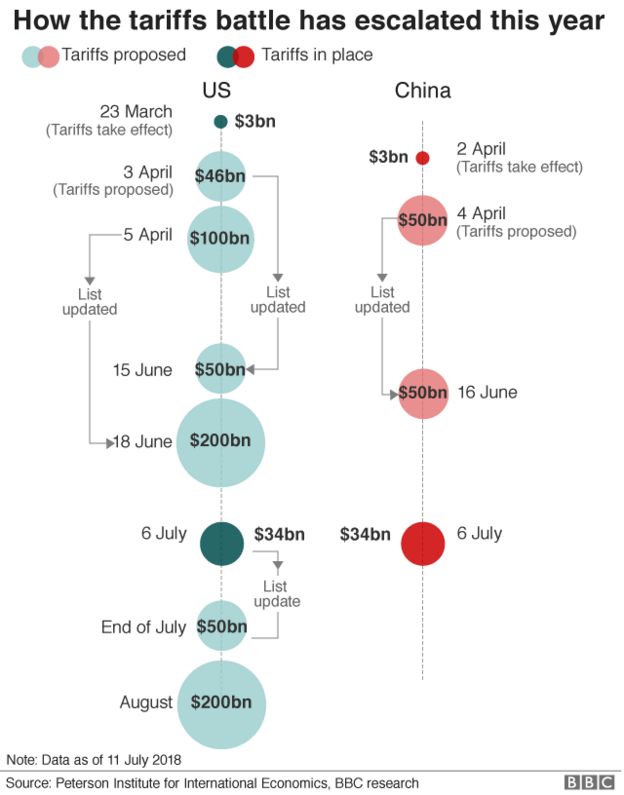

In May, China announced that it would cut tariffs on imported cars from 25% to 15% on 1 July in a move seen as an attempt to reduce trade tensions with the US. But shortly after, on 6 July, it increased tariffs on US-made cars to 40% in retaliation to the US’s move to tax $34bn of Chinese products. “Ironically some of the hardest-hit companies are American or producing in the US, even though the tariffs imposed by the US are intended to help domestic companies.”

And of course there is Harley-Davidson, which plans to shift some production away from the US to avoid the “substantial” burden of European Union tariffs, imposed in retaliation to US duties on steel and aluminium.

II) Food and Drink Victims

Tyson Foods recently cut its profit forecast, saying retaliatory duties on US pork and beef exports had lowered US meat prices. US spirits and wine giant Brown-Forman has said it will increase the price of Jack Daniel’s and other whiskeys in some European countries, according to media reports. Coca-Cola has said it will increase prices in North America this year to compensate for higher freight rates and metal prices, according to the Wall Street Journal.

III) Other Victims – Toymakers, Commercial/Consumer Products, Furnishing, Equipment Manufacturers

Toymaker Hasbro is moving more production out of China. US commercial and consumer products conglomerate Honeywell wants to use more supply chain sources from countries outside China, and home furnishing company RH expects to cut the amount of goods sourced from China, according to Reuters. Meanwhile, US equipment maker Caterpillar recently said strong demand had allowed it to hike prices to offset $100m-$200m in higher steel and aluminium costs. The International Monetary Fund says an escalation of the tit-for-tat tariffs could shave 0.5% off global growth by 2020.