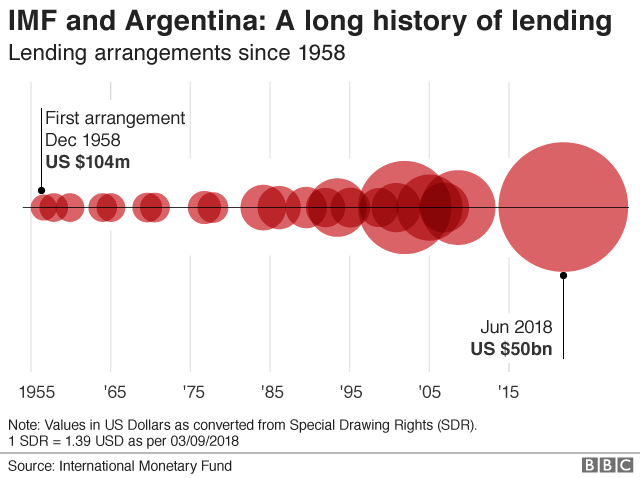

The newest Argentinean Crisis required another trip to the IMF. The BBC details the long sorted history of Argentina and the IMF (here) and (here): The Expenditure Reducing measures announced (exceeded the IMF requirements) include “taxes on exports of some grains and other products” and “about half of the nation’s government ministries will be abolished” and “half of ministry jobs being axed.” This after January’s cuts that froze government employees’ pay and cut “one out of every four ‘political positions’ appointed by ministers.”

The Expenditure Reducing measures announced (exceeded the IMF requirements) include “taxes on exports of some grains and other products” and “about half of the nation’s government ministries will be abolished” and “half of ministry jobs being axed.” This after January’s cuts that froze government employees’ pay and cut “one out of every four ‘political positions’ appointed by ministers.”

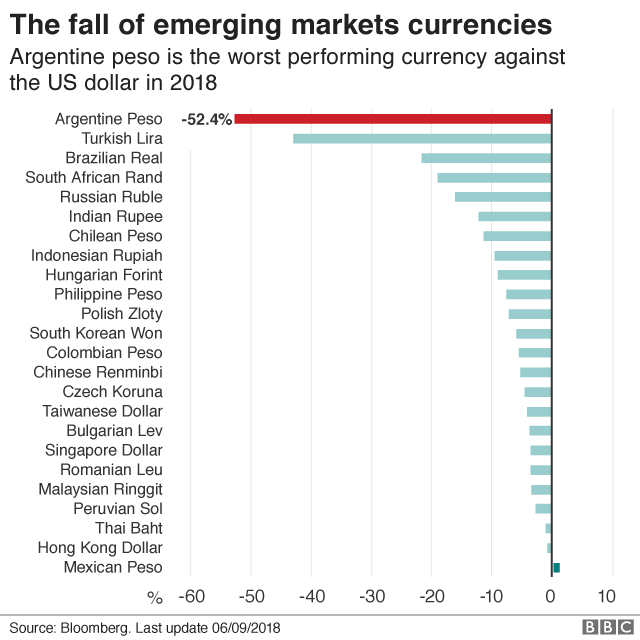

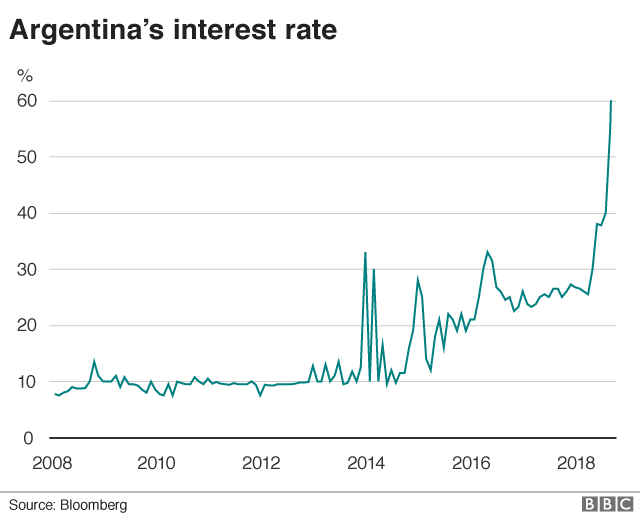

The measures are designed to stabilize the value of Argentina’s currency, which has lost about half its value this year against the US dollar, despite the central bank raising interest rates to 60%(!).

While these measures go beyond the IMF’s conditionality (FMI abbreviated in Spanish), Argentinians learn one thing: call the IMF and the country goes into a real crisis. Why?

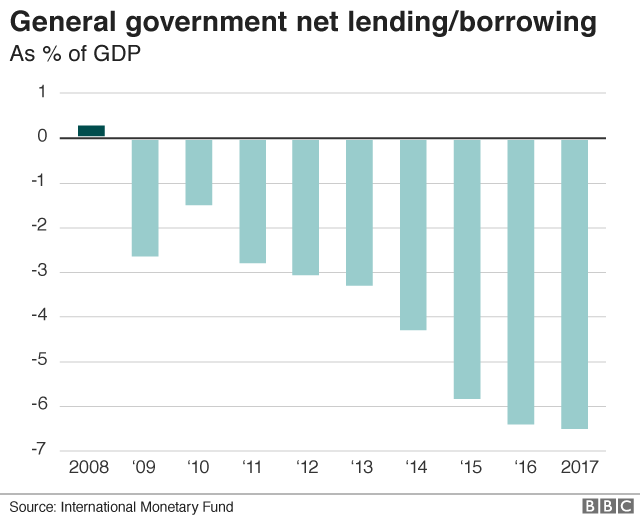

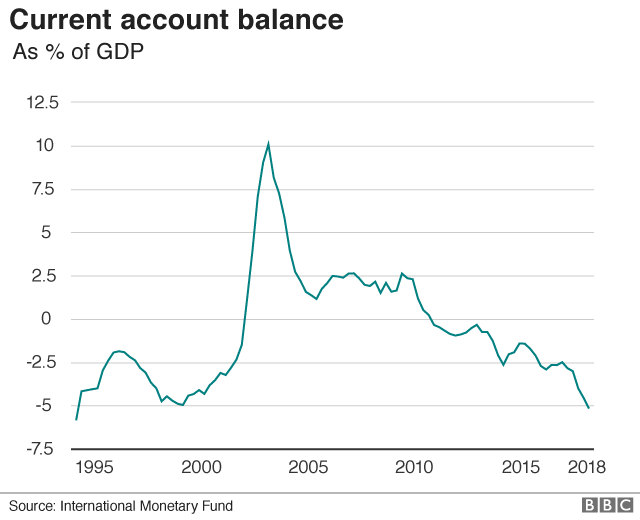

As background info, the BBC provides key statistics

Why do you think the BBC chose these graphs?