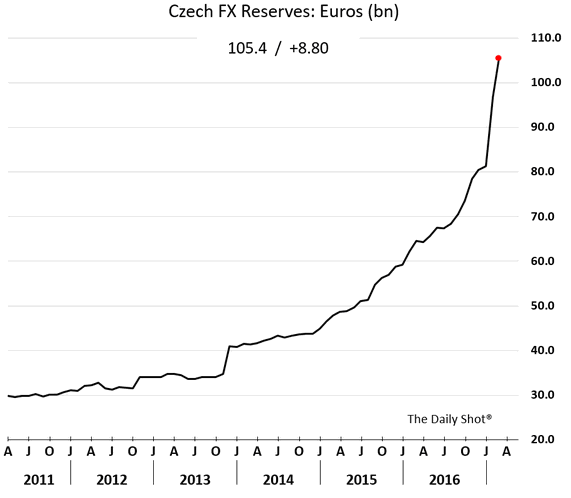

Markets are preparing for the Czech National Bank (CNB) to remove the cap on the Czech currency, the koruna. Here is the koruna (CZK) vs. the euro (EUR). Maintaining a fixed exchange rates implies a cap on the price of foreign currency which has forced the central bank to keep buying euros (and selling koruna) to make sure the koruna doesn’t appreciate above the target level. This policy has resulted in the CNB holding huge amounts of euros.

Maintaining a fixed exchange rates implies a cap on the price of foreign currency which has forced the central bank to keep buying euros (and selling koruna) to make sure the koruna doesn’t appreciate above the target level. This policy has resulted in the CNB holding huge amounts of euros.

Source: Goldman Sachs, @joshdigga

Source: Goldman Sachs, @joshdigga

Foreigners who bought the koruna (and sold euros to the Czech central bank) have invested in Czech bonds. They are hoping to see a pop [aka a spike in return] when the CNB abandons its currency cap driven by the increase in the value of the investment as the koruna appreciates (although much of this cap removal is already priced into these bonds).