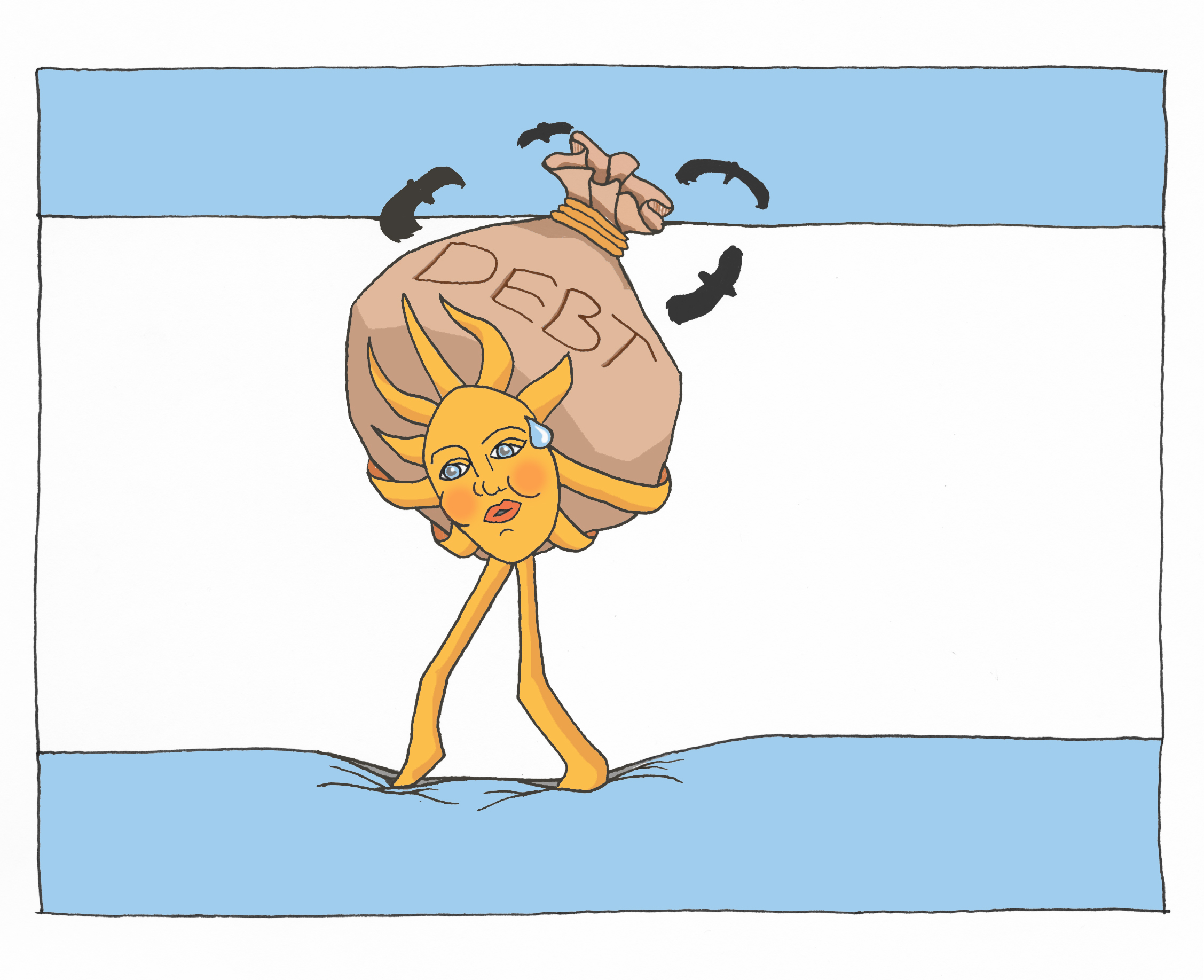

Argentina has been in crisis mode for much of 2018 (see here, here, here, and here). Today the WSJ reports that Argentina received the largest IMF program loan ever. While the IMF recommended a currency board in 1989 (which failed in 2001), it now requires Argentina “to maintaining a floating exchange-rate regime without intervention” and to reduce its fiscal deficit to zero, indeed to a surplus (!) by 2021 (WSJ).

This is a nice application of the TB/Y or the Mundell Fleming Model (as the capital account opened up again recently) to figure out how a huge reduction in government spending (~6.5% of GDP) and a flexible exchange rate will affect Argentina and its reserves vs the currency board medicine which had previously been prescribed by the IMF. Source:

Source: