Dani Rodrik expounds the virtues and pitfalls of the Chinese exchange rate manipulation. For a change, he does not focus on US-Chinese economics, but on the impact of the undervalued Yuan on poor countries.

a) use the large open economy diagram to show how the absence of FX intervention no the part of the Chinese Central Bank, and the associated one-time depreciation of the Chinese yuan, would affect China and poor countries

b) explain why the artificially weak Yuan is equivalent to Mercantilism or Neo-Mercantilism.

c) If China implements high tariffs on imported goods, do you think that its propensity to import is big or small?

d) What would such a tariff mean for output in poor countries that reply on China as a trading partner?and How does this relate to Rodrik's point abou the poor countries' core problem?

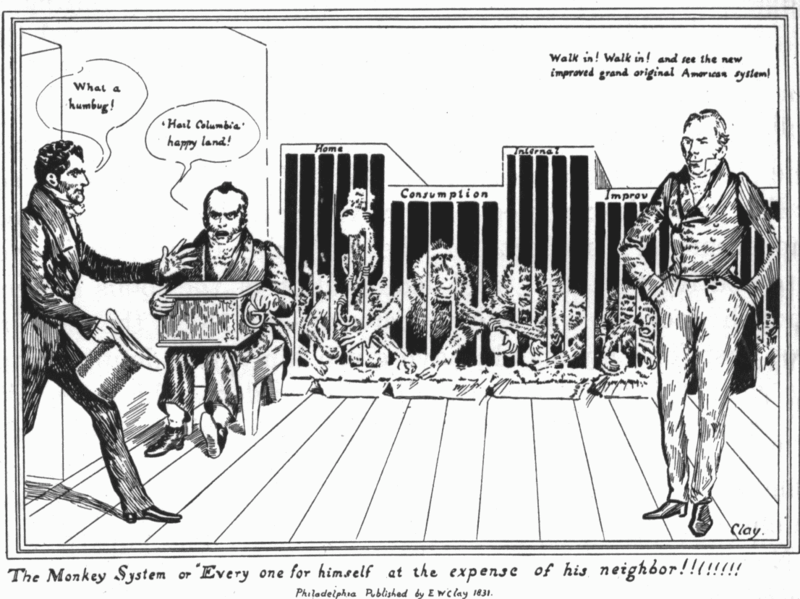

It turns out the US has its own history of trade manipulation. Cartoonist E.W. Clay published the below cartoon in 1831 to lampoon the "American System" of Protection as a "Monkey System" where "Every one for himself at the expense of his neighbor!"

(Source)

The “American System,” was the first US government-sponsored attempt to invigorate

the national economy through trade manipulation. It implemented Alexander Hamilton’s ideas, as outlined in his 1792 “Report on Manufacturers.” At the time he proposed a protective tariff of 20-25 percent on imported goods – such as woolens, cottons, leather, fur,

hats, paper, sugar and candy, to protect the nation’s fledgling

industries from foreign competition. Congress finally passed the tariff in 1816.