So You Want to Fix the Trade Deficit?

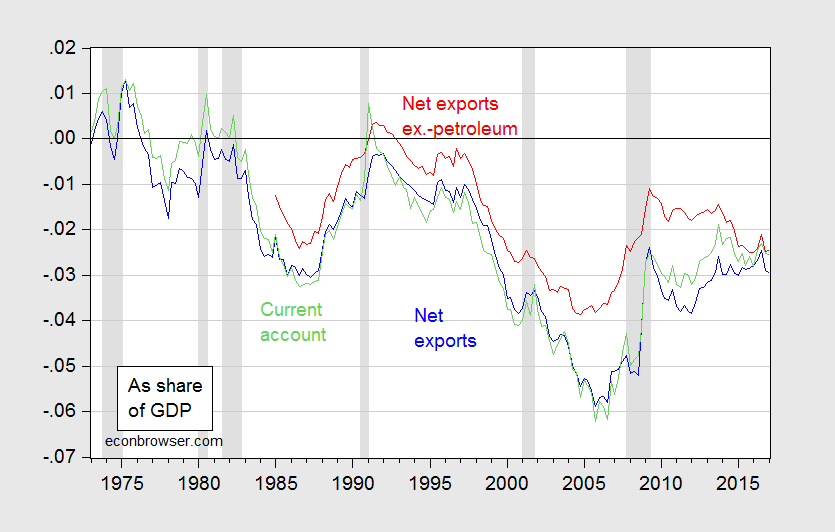

Figure 1: Net exports (blue), net exports ex.-petroleum products (red), and current account (light green), as a share of nominal GDP. NBER defined recession dates shaded gray. Source: BEA, 2017Q1 3rd release and author’s calculations.Notice that net exports have improved since the onset of the Great Recession, in part because of

a) slower growth

b) a depreciated dollar

c) an increases in petroleum product exports (as highlighted by the fact that the ex-petroleum net export series moving closer to balance than the overall).

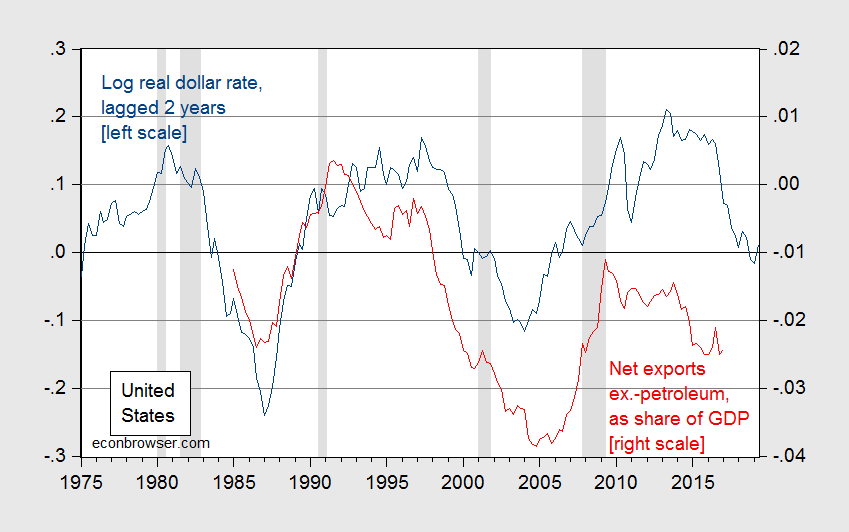

The dollar’s value is one key factor in these movements. Below in Figure 2, the trade weighted dollar is graphed (the dollar exchange rate against a broad basket of currencies, in Chinn’s definition, a downward movement is a appreciation), lagged two years, against net exports, ex-petroleum. Figure 2: Log US dollar exchange rate against a broad basket of currencies, lagged two years (dark blue), net exports ex.-petroleum products as a share of nominal GDP (red). Exchange rate defined as downward movement is a dollar appreciation. NBER defined recession dates shaded gray. Source: BEA, 2017Q1 3rd release and author’s calculations.

Figure 2: Log US dollar exchange rate against a broad basket of currencies, lagged two years (dark blue), net exports ex.-petroleum products as a share of nominal GDP (red). Exchange rate defined as downward movement is a dollar appreciation. NBER defined recession dates shaded gray. Source: BEA, 2017Q1 3rd release and author’s calculations.

So, the question is whether trade measures will have a noticeable impact on the trade balance (this is a separate question from whether it’s welfare improving to impose such barriers). The answer depends in large part whether you think the impacts of US income and the dollar’s value (the two key variables) are going swamp any changes in relative prices coming from tariffs and quotas imposed at the sectoral level.

I tend to think that level of US national saving (the sum of government budget surplus and private saving) and desired investment tend to drive the trade balance (approximately the current account, as shown in Figure 1) more than the trade balance drives the US budget balance, private saving and investment. In that framework, trade protection measures have second order effects, unless they were to drastically change these macro aggregates. Tariff revenues are too small to affect the budget balance. It is hard to see how they increase private savings; maybe they could affect investment in protected sectors — but that works in the wrong direction. (More on the national saving identity here).

So, the Trump project of reducing trade deficits through protection, while maintaining growth (protection which triggers retaliation and a global slowdown could “work” to reduce the US trade deficit) is doomed to fail.