International Economics usually covers the concept of sterilization in the context of central banks' intention. That is, Central Banks "sterilize the effects of foreign currency interventions" when Central Banks buy or sell foreign currency, so minimize the effect on the domestic money supply.

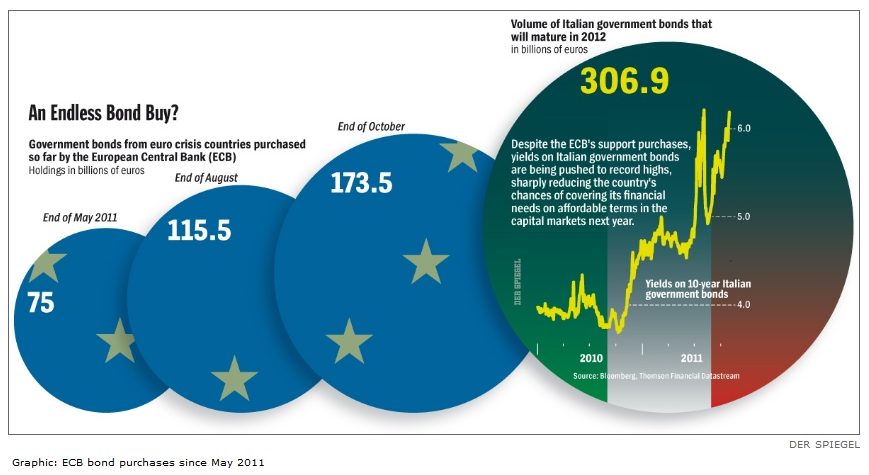

In Europe the GIPS countries have encountered serious economic crises, that resulted in huge goverment deficits and massive public debt. To allow these countries to remain in the EU, the European Central Bank (ECB) decided to buy their debt and thus keep the interest on the debt managable. Of course every time the ECB purchases government debt, it increases the money supply – much the chegrin of other EU countries who fear inflation. In response the ECB is "sterliziing" these bond purchases. Here is the article:

Questions:

1. Why does the WSJ say the the ECB sterilizing its money supply?

2. If Eurozone countries start to struggle with a trade deficit that continues for a long period of time, what will eventually happen to their foreign reserves? Draw a graph to illustrate your point.

3. What are some policy options countries can take if they want to correct their trade deficits or their fiscal deficits?