President Trump signed the “Tax Cuts and Jobs Act” into law on Dec. 22., 2017, bringing sweeping changes to the tax code. The tax cut features temporary changes to the individual tax code and permanent changes to corporate taxes. Overall it is a $1.5+ trillion overhaul. Investopedia has the details. The tax cuts permanently remove the “individual mandate,” which was a key provision of the Affordable Care Act; this will raise health care insurance premiums and significantly reduce the number of people with coverage. The highest earners are expected to benefit most from the law, while the lowest earners may actually pay more in taxes once most individual tax provisions expire after 2025.

For the wealthy, banks and other corporations, the tax reform package can be considered a lopsided victory given its significant and permanent tax cuts to corporate profits, investment income, estate tax and more. Financial services companies, especially, stand to see huge gains based on the new, lower corporate rate (35% to 20%) as well as more preferable tax treatment of pass-through companies. Some banks have said that their effective tax rate will drop under 20%.

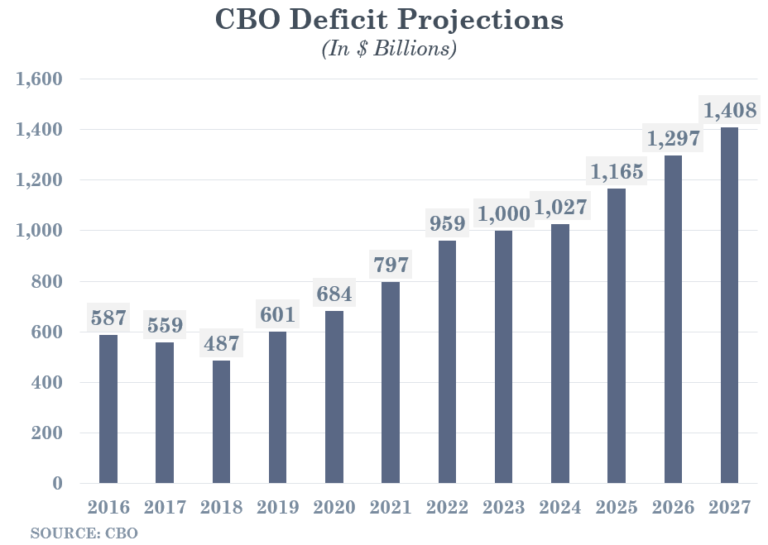

The overhaul is forecast to raise the federal deficit by hundreds of billions of dollars – and perhaps as much as $2.0 trillion – over the coming decade. Estimates vary depending on assumptions about how much economic growth the law will spur, but no independent estimates follow Treasury Secretary Steven Mnuchin, who is by law required to study the impact of the tax change on US dept predicts net reduction to the national debt as a result of the overhaul. The entire study of the trillion dollar overhaul by Mnuchin was a single paragraph.

The Peterson Foundation reports that, on October 15, 2018 the Department of the Treasury released its tally of budget totals for fiscal year 2018. In that report, they showed that corporate income tax receipts fell from $297 billion in 2017 to $205 billion in fiscal year 2018 — a 31 percent drop. Such a large year-over-year drop in corporate income tax revenue is unprecedented in times of economic growth. The 31 percent drop in corporate income tax receipts last year is the second largest since at least 1934, which is the first year for which data are available. Only the 55 percent decline from 2008 to 2009 was larger. While that decrease can be explained by the Great Recession, the drop from 2017 to 2018 can be explained by tax policy decisions.

The falloff in corporate tax collections in 2018 exacerbated the growth in the annual deficit, which rose by $113 billion relative to 2017 (from $665 billion to $779 billion). Looking ahead, deficits are expected to continue rising in the years to come, and diminished corporate tax revenues will be an important contributor to those deficits. (source)

(source) (source)

(source)