He’d like to make trade great again. So, on March 3, 2017, President Trump rolled out his trade strategy. No one summarizes it better than Menzie Chinn, and I am reproducing the analysis in his blog (spoiler alert: the Trump trade strategy may likely end up being contractionary):

The Administration rolled out a new trade strategy yesterday (The President’s 2017 Trade Policy Agenda, part of this document)… If the Administration pursues a trade agenda that invites trade retaliation, while implementation of stimulative macro policies (e.g., infrastructure investment, tax cuts) are delayed, then we may very well get an economic slowdown before a boom. From the document: “It is time for a more aggressive approach. The Trump Administration will use all possible leverage to encourage other countries to give U.S. producers fair, reciprocal access to their markets…”

From WaPo: The new trade approach, which was sent to Congress Wednesday, could affect businesses and consumers worldwide, with the White House suggesting the United States could unilaterally impose tariffs against countries it thinks have unfair trade practices — paving the way for a more adversarial relationship with China and other trading partners — and punish companies that relocate overseas and then attempt to sell products on the U.S. market… Trump’s threatened tariffs and other trade barriers could violate WTO rules and bring blowback from other countries in the trade organization. But the agenda signals the Trump administration could simply ignore those complaints… Chad Bown, a senior fellow at the Peterson Institute for International Economics, said he fears the administration’s criticism of WTO rules could end up creating a more lawless global system. “The difficulty is, once we step away from that and say the WTO rules imply a lot more flexibility in what we’re allowed to do, we can be 100 percent certain other countries will start to do the same. That’s what will ultimately undermine the U.S. system, and there will be big repercussions for U.S. exporters.”

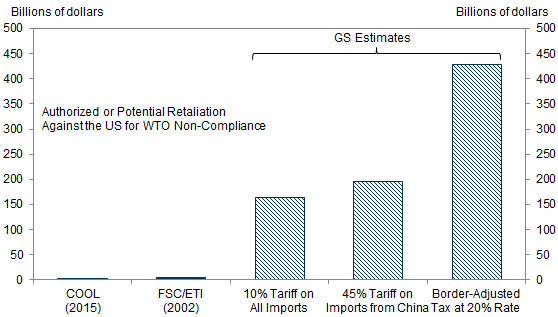

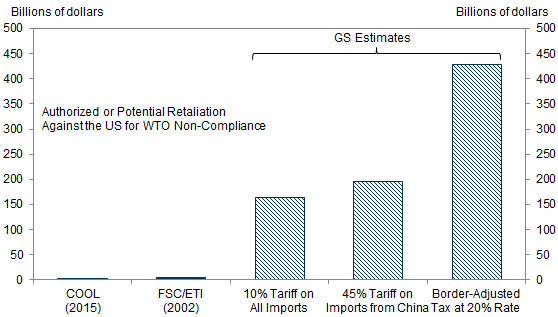

So retaliation is a distinct possibility. The amount of the potentially authorized retaliation against the U.S. is not trivial. From Mericle and Phillips, “US Daily: Trade Disputes: What Happens When You Break the Rules?” Goldman Sachs, February 17, 2017 (not online):

Exhibit 3 A WTO Case against Recent US Trade Policy Proposals Would Likely Be Unprecedented in Size.  Source:Mericle and Phillips, “US Daily: Trade Disputes: What Happens When You Break the Rules?” Goldman Sachs, February 17, 2017 (not online), based on data from World Trade Organization, Goldman Sachs Global Investment Research.

Source:Mericle and Phillips, “US Daily: Trade Disputes: What Happens When You Break the Rules?” Goldman Sachs, February 17, 2017 (not online), based on data from World Trade Organization, Goldman Sachs Global Investment Research.

Frankly, I didn’t even contemplate the fact that the amounts could be so large… From the GS Note: How such a scenario would play out is extremely uncertain. But in light of the magnitude of the potential violation, the likelihood that a WTO case would be lengthy, the fact that authorized penalties would not be retroactive, and the domestic political pressures that would quickly mount, press reports suggesting that the EU, Mexico, and China would likely respond quickly are unsurprising. It is difficult to know how President Trump might react to an adverse ruling from the WTO, an organization he has called a “disaster,” or to foreign retaliation. But reversing a large tariff, let alone a fundamental corporate tax reform, would be difficult politically, raising a risk of escalation that could undermine current multilateral trade agreements.

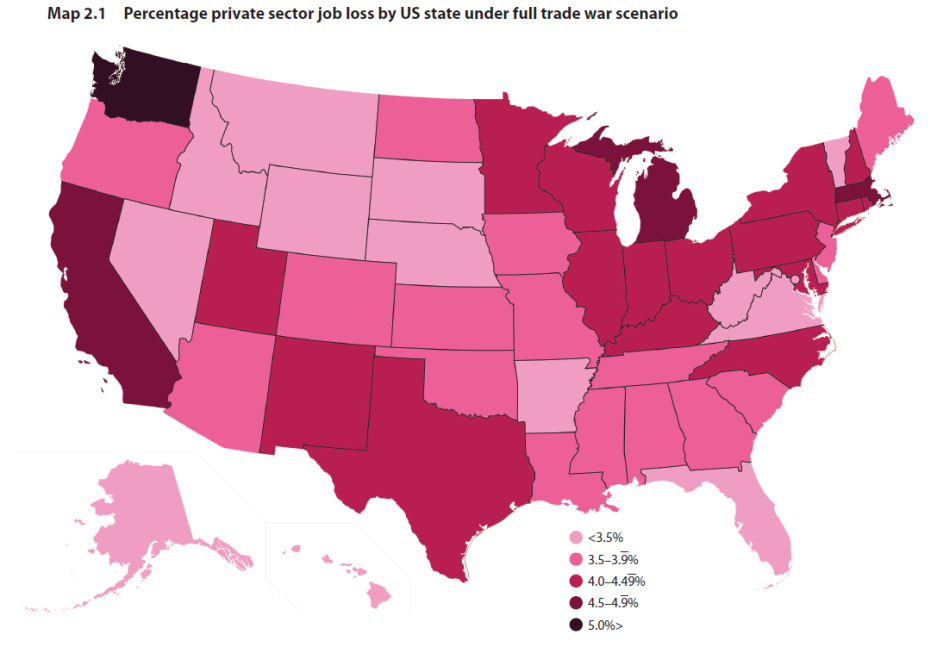

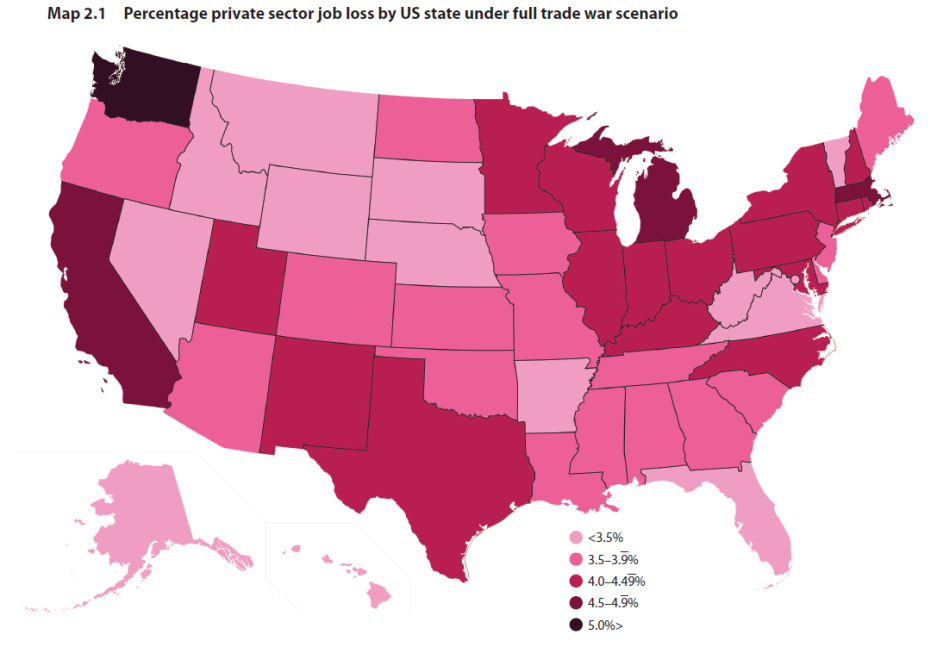

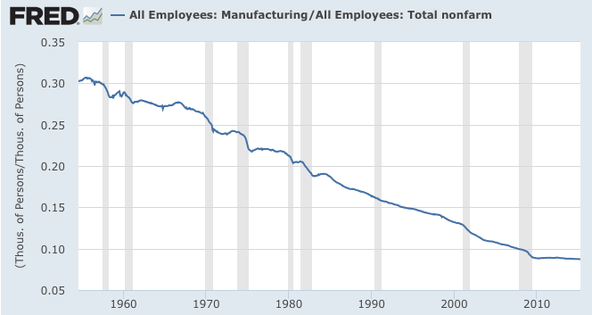

By the way, I have not discussed the macroeconomic impact of a full-fledged trade war (see here). Here’s a depiction of the impact on employment, state-by-state.

Predicted Job Losses Due To Trade War, state-by-state.

Source: Marcus Noland, Gary Clyde Hufbauer, Sherman Robinson, and Tyler Moran, “Assessing Trade Agendas in the US Presidential Campaign,” PIIE Briefing 16-6 (September 2016).

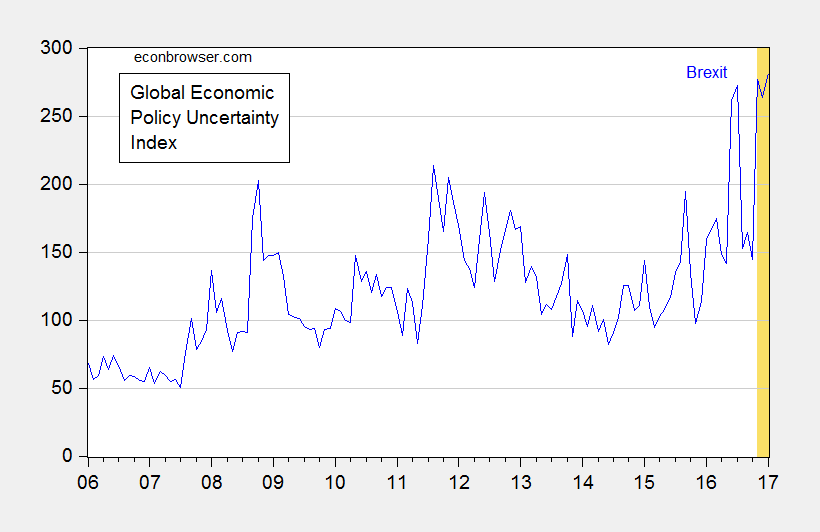

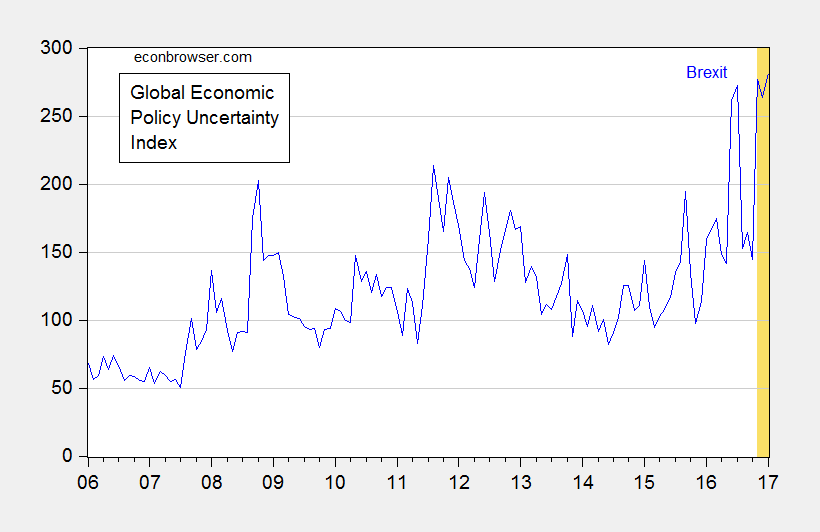

And, for all those people who bemoaned policy uncertainty as slowing down economic growth, over the past eight years, something to consider — again from WaPo: Stan Veuger, a resident scholar at the American Enterprise Institute, said the administration’s plan to continually reevaluate existing trade relationships could end up disrupting American business. “All those things together create a system where the U.S. government may intervene in arbitrary and unpredictable ways in trade relationships, and I don’t think that kind of framework is very helpful for the creation of lasting, worthwhile relationships between firms in the U.S. and firms abroad,” he said. “It just makes the business environment more uncertain.”

Here is the Baker, Bloom and Davis measure of global economic policy uncertainty through January 2017.

Figure 1: Global Economic Policy Uncertainty Index, Market GDP weights (blue). Orange denotes post-election period.

Source: Policyuncertainty.com, accessed 3/2/2017.

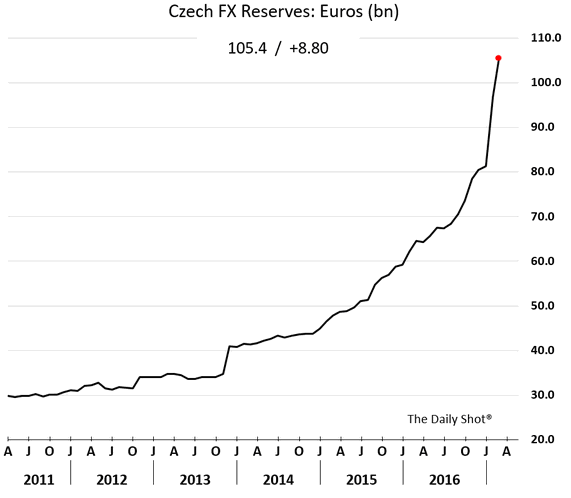

Maintaining a fixed exchange rates implies a cap on the price of foreign currency which has forced the central bank to keep buying euros (and selling koruna) to make sure the koruna doesn’t appreciate above the target level. This policy has resulted in the CNB holding huge amounts of euros.

Maintaining a fixed exchange rates implies a cap on the price of foreign currency which has forced the central bank to keep buying euros (and selling koruna) to make sure the koruna doesn’t appreciate above the target level. This policy has resulted in the CNB holding huge amounts of euros.

Source: Goldman Sachs, @joshdigga

Source: Goldman Sachs, @joshdigga Source: @fastFT

Source: @fastFT

Source:Mericle and Phillips, “US Daily: Trade Disputes: What Happens When You Break the Rules?” Goldman Sachs, February 17, 2017 (not online), based on data from World Trade Organization, Goldman Sachs Global Investment Research.

Source:Mericle and Phillips, “US Daily: Trade Disputes: What Happens When You Break the Rules?” Goldman Sachs, February 17, 2017 (not online), based on data from World Trade Organization, Goldman Sachs Global Investment Research.