Home ownership in Washington has followed a disturbing pattern in recent decades. While more than two-thirds of White families are able to own homes, most Black and Latino families do not. And for Black households the trend has gotten worse. In recent census reports the disparity is beyond alarming: 69% of White families are homeowners compared to only 34% of Black families. Fifty years ago, in 1970, 50% of Black families owned homes. Since them it has fallen decade after decade.The charts below tell the story

The disparate rate of homeownership is only part of the problem. The homes owned by Black, Indigenous, and Latino households tend to be worth less than those owned by Whites, especially in the high-price metro areas. In Seattle and King County, the small number of Black families owning homes (28%) owned property whose median value was just 75% of the median value of White-owned homes. Homes owned by Latinx and Indigenous households are also worth less. This value disparity is not new, as the graph below shows.

That fact helps explain the declining ownership rates of Black families. The following chart shows the exponential increase in property values in Seattle/King County since 1970. That year, the high point for Black homeownership, Black-owned homes were worth 72% of White-owned homes. Think about what that meant for families who had been locked out of the housing market. In 2021-22, the median home in King County was valued at more than 35 times as much as in 1970 ($790,000/$22,500 = 3,511%). This far exceeded overall inflation and the rate of increase in family incomes (927%). A family selling a full-valued home could take advantage of this rocketing market, exchanging one house for another or dispersing housing assets through inheritance. But a family trying to buy for the first time in the post-covenant-restriction decades (and those selling undervalued homes) needed much higher incomes to buy property.

Since then, and especially since the 1990s, home buying in the expensive parts of the state (Puget Sound) has required different resources than it did in the golden age of mass homeownership after World War II (1946-1970) when Federal Housing Authority (FHA) assistance helped most White families become homeowners. Buyers have needed wealth to get started; wealth in the form of inheritance or high-paying jobs. Highly paid business-class and professional-class migrants from California, New York, and across the Pacific have been able to join this pricey housing market, while those with modest incomes and without family property wealth have lost out.

In rural areas and the cities outside Puget Sound housing price escalation has been more modest, but that has not substantially altered the disparate homeownership rates. Below are graphs for Spokane and Yakima counties in eastern half of the state and below that Seattle/King and Tacoma/Pierce counties in the more expensive Puget Sound. In Yakima County, where housing prices are only one-third of Seattle/King County values, about half of Latino families are homeowners and the tiny population of African Americans keeps pace. But in Spokane County, the distributions are similar to Puget Sound despite much lower property values.

Indigenous American and Asian American homeownership rates have been higher than Black and Latinx rates people in many counties since the 1970s. This relects increased access to ownership on tribal lands on the one hand and changing patterns of immigration on the other. The rapid growth of Asian American populations since the 1965 Immigration Reform Act, has brought many people with professional and business skills and some with investment wealth. In recent decades Asian Americans have recorded homeownership rates and home values comparable to White families.

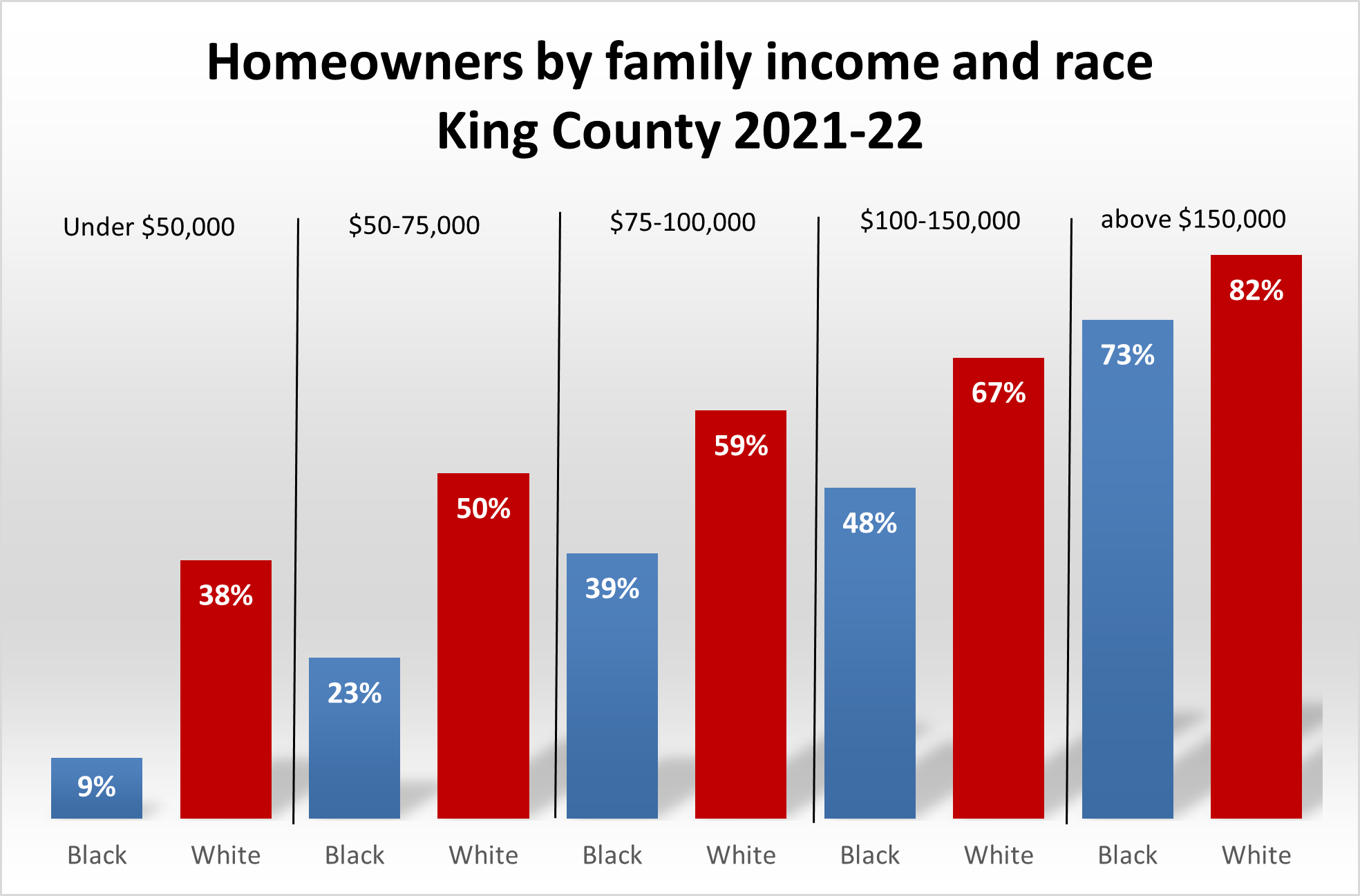

The enormous disadvantage that Black families face in Washington state is made clearer when we consider income. At every income level, White families are more likely to own homes than Black families. The chart below shows ownership rates in recent census counts. Among families earning more than $150,000 annually, 88% of Whites are homeowners compared with 77% of Blacks. The gap grows larger at the $100,000 and above income level and starker still at more modest family income levels. Look at the difference among those earning less than $50,000. White families are almost four times more likely to be homeowners than Black families. Remarkably, 49% of White families at this modest income level are able to own homes. Here we see the effects of multigeneration wealth building. At current prices new buyers with modest incomes are shut out of homeownership unless they are converting homes long held in the family or other sources of wealth.

Below are similar charts for the for the four most populous counties. In every case, Black families are less likely to own homes than White families at the same income level.

The most recent years shown here is an average of 2021 and 2022 from annual American Community Surveys (ACS). The 2-year average improves the reliability of these calculations, all of which are based on samples of the full population (2% for 2021-22 and 1970; 5% in other years). Because these are samples, it is unwise to report very small populations. For that reason the Latino category is not reported until 1980 and the category "Other race" is not shown here.

Households as defined by the Census Bureau can include single individuals or a group of roommates as well as actual families. The race of the household follows the self-identified race of the person designated "head of household." Home valuations are from Census data and these estimates are not the same as assessed or market values. The Census Bureau asks about home values and families answer this question with little guidance. Homes in these calculations include condos as well as houses and ownership can mean buying with a mortgage or owning outright (which is most likely for White homeowners).

Race categories in these calculations treat Latino as an exclusive category. Thus the labels Black, White, Indigenous, and Asian do not include anyone who indicated Hispanic/Latino heritage. The category Asian, always complicated, includes Pacific Islanders, South Asians, and East Asians. These charts do not include persons who answered with two or more race categories. Only in recent census surveys was this an option and in this six decade report and charts, we were not able to include them.

Sources: These statistics are calculated from weighted samples of U.S. Census data produced by the Minnesota Population Center's IPUMS USA: Steven Ruggles, Sarah Flood, Ronald Goeken, Megan Schouweiler and Matthew Sobek. IPUMS USA: Version 12.0 [dataset]. Minneapolis, MN: IPUMS, 2022. https://doi.org/10.18128/D010.V12.0. The following samples: 1960 5%, 1970 1% Metro FM1 and F2, 1980 5% State, 1990 5% State, 2000 5%, 2010 10%, 2021-2022 ACS 2yr.