Crisis year 2022 brought $134 billion in excess profit to the West’s five largest oil and gas companies The world’s five largest oil and gas companies made a record $195 billion in profits in 2022, up almost 120% from the previous year, thanks to the global energy crisis triggered by Russia’s invasion of Ukraine and climate change. Global Witness assessed the financial returns of Chevron, ExxonMobil, Shell, BP, and TotalEnergies and found that together, they made $134bn in excess profits…

Category: Global Theft

Much of our global health work is defined by what we can do – or we can’t do – in the context of resource scarcity. But we also know that most countries have more than enough resources to achieve health for all. Resource scarcity is largely a myth, and the real problem is global theft of those resources. The GH community, however, rarely draws attention to the systematic theft of these resources, either by, or enabled by, people in rich countries. Rich individuals, including those considered global health saviors, and their large corporations move money from accounts in one country to another in order to avoid paying taxes, and not contributing their fair share to efforts that could improve global health. Other examples include expropriation of raw materials, like water, without fair compensation, patents and trade regimens that are highly unfair, currency speculation, corporate practices that engender poverty wages and dangerous working conditions, and environmental devastation.

Poverty and Exploitation in Jobs, Housing, Banking

Desmond describes the structural role of exploitation in the persistence of poverty in the USA – that is also highly relevant to poverty globally. While we try to promote programs to aid the poor, ‘we have not confronted the unrelenting exploitation of the poor in the labor, housing, and financial markets,” This simply means that we underpay the poor relative to the value they produce and overcharge them relative to the value of what they purchase. Such exploitation is endemic…

Is Bill Gates a barrier to fair taxation?

Fair taxation is fundamental to global health. Taxes provide the necessary resources to finance strategies to improve health, including social determinants of health (education, nutrition, housing, water, sanitation) and health care. Taxes provide resources for the public health infrastructure that is essential to implement and scale up the technologies and programs developed by the Gates Foundation. Taxes are also a mechanism to reduce the unconscionable income and wealth inequality that enormously impacts global health. As important as it is, fair…

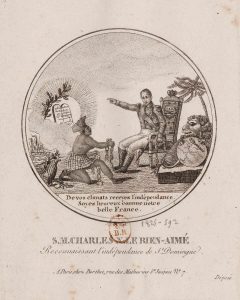

Haiti’s stolen billions

For more than a century, Haiti has been labeled a disaster, a basket case, a place so destitute, indebted, lacking and lawless that it needs constant saving. The assassination of the president in his bedroom, the kidnappings in the capital, the swells of Haitian migrants heading to the United States — they all point to a country in a seemingly endless vortex of despair that the world’s great powers, whether with troops or mountains of aid, have not managed to…

[BOOKS] on Global Theft

Here are some excellent books on global theft that relate to global health: A Brief History of Equality, by Thomas Picketty (2022) An excellent history of social/political movements and resulting national policies in dozens of countries that have markedly improved equality since 1780. With impressive data, he shows that progressive taxes on income and wealth and a comprehensive welfare state, including provision of education, health care, old-age pensions and protection against severe deprivation have made enormous progress in reducing inequality…

[PODCAST] USA – global leader on the 2022 Financial Secrecy Index

Naomi Fowler (Tax Justice Network) May 2022: “We’re hearing a lot from world leaders about sanctions against Russian oligarchs at the moment. We know financial secrecy is what the powerful, the corrupt, and criminals really love. With financial secrecy they can undermine the democratic will of any country’s government. They can drain the tax revenues that stop the rest of us living secure and happy lives. So which nations are the world’s worst offenders when it comes to financial secrecy? I’m…

Tax justice network: The 4 Rs of tax justice

If revenue losses due to global tax abuse were reversed, every year 17 million more people could benefit from clean water and 34 million from basic sanitation – preventing 600,000 child deaths and 73,000 maternal deaths. International cooperation to progressively raise more state revenue, tax policies to foster social redistribution in the context of extreme inequality, repricing the adverse social/environmental costs of production, and representation to demand transparency and accountability. Taxation policies are key drivers of global health, and must…

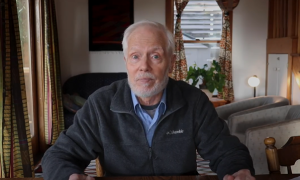

[VIDEO] Global Theft in Global Health

This the first in a series of short videos on the topic of global theft and GH So much of global health these days is defined by what we can do – or we can’t do – in the context of resource scarcity. Low cost interventions like, say, task shifting to CHWs, or to TBAs are typical of our approach to GH to save money. But it’s important to remind ourselves that the concept of resource scarcity in most LICs…