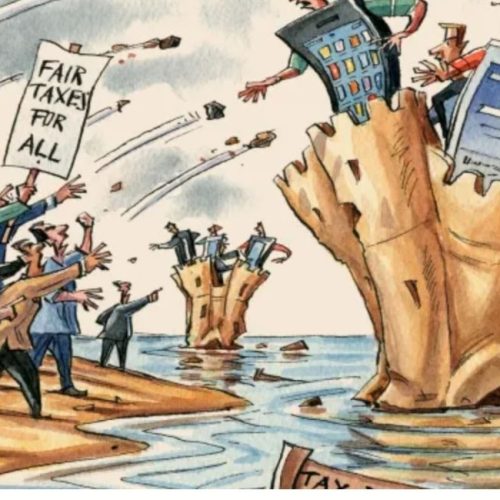

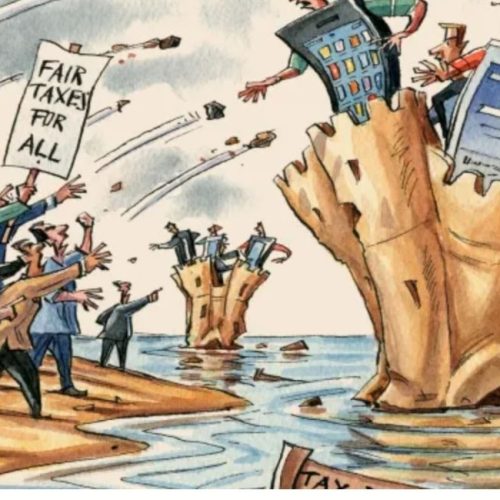

Tax Evasion

May 15, 2024

Fair Taxation: Urgent Call for action in G20 and UN

Oxfam’s February 2024 analysis reveals a troubling trend: the wealthiest 1% in G20 countries are benefiting from significantly reduced tax rates, widening the gap between the rich and the rest. This alarming disparity, coupled with a decline in democracy, underscores the urgent need for policy reform. As finance ministers convene in São Paulo, they must…

January 22, 2024

UN Tax Reform offers hope to Low Income Countries

In late November 2023, developing countries at the UN won a historic vote to set up a tax convention in spite of resistance from rich countries. This Guardian editorial (see below) explains how poor nations’ ability to feed, educate and provide healthcare to their people is hobbled by illicit and hidden movements of capital worth…

July 31, 2023

Countries on course to lose $4.7 trillion to tax havens over next 10 years

The tax justice network recently released its 2023 State of Tax Justice report that estimates that, if no action is taken, countries will lose nearly US$5 trillion in tax to multinational corporations and wealthy individuals using tax havens to underpay tax over the next 10 years. Lower incomes countries’ tax losses ($46 billion) are equivalent…

June 7, 2022

Is Bill Gates a barrier to fair taxation?

Fair taxation is fundamental to global health. Taxes provide the necessary resources to finance strategies to improve health, including social determinants of health (education, nutrition, housing, water, sanitation) and health care. Taxes provide resources for the public health infrastructure that is essential to implement and scale up the technologies and programs developed by the Gates…

May 18, 2022

[PODCAST] USA – global leader on the 2022 Financial Secrecy Index

Naomi Fowler (Tax Justice Network) May 2022: “We’re hearing a lot from world leaders about sanctions against Russian oligarchs at the moment. We know financial secrecy is what the powerful, the corrupt, and criminals really love. With financial secrecy they can undermine the democratic will of any country’s government. They can drain the tax revenues that…