DIALOGUE ON RESEARCH AND POLICY No. 5

Assets, Credit, and Debt: Issues and Opportunities for Low-Income Families

PROJECT SUMMARY

With funding from the Northwest Area Foundation, WCPC Affiliate and Professor of Public Affairs Marieka Klawitter and Colin Morgan-Cross analyzed patterns of credit, debt, and asset-holding across households with a focus on how low-income families differ from other families. The WCPC shared these findings with a group of practitioners from northwest states and then hosted a conversation to get input about the research and its implications for practice. In this brief, we present a summary of findings from the original report, followed by highlights from the discussion between the researchers and practitioners about the data and its relevance for their work.

Key Findings

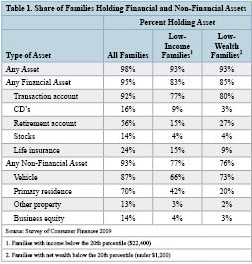

Findings draw on the results from the 2007 and 2009 Survey of Consumer Finances (SCF) , the FINRA National Financial Capability Survey (NFCS) , and existing research. A snapshot of current levels and types of wealth shows that the vast majority of households, including low-income households, report having some assets. However, the types of assets held vary by income, with low-income families reporting much lower ownership of both financial and non-financial assets. Low-income households are less likely than all households to hold financial assets, particularly retirement accounts. While over half (56%) of all families report having a retirement account, only 15% of low-income families report having one. Low-income families are also less likely to hold non-financial assets such as vehicles and homes.

Access to credit can allow households to smooth economic shocks, such as unemployment, and to build assets over time through a mortgage, education, or vehicle loan. Low-income households are less likely to hold any debt, and hold different types of debt than do higher-income households. Low-income households are significantly less likely to have a mortgage, home equity line of credit, credit card balance, or education loan than the average household, but are more likely to have a vehicle loan. These differences in types of debt held may reflect both less access to credit (e.g., ineligibility because of poor credit scores) as well less interest in these types of mainstream financial products.

Practitioner Response

The research findings both resonated with practitioners and stimulated a discussion of additional issues including different types of prevalent debt, the extent to which the data reflects these types of debt, and the challenges associated with maintaining debt as good credit rather than an increasing liability. The discussion also turned to the ripple effects of debt and possible unintended consequence of policy decisions or programs designed to address asset and debt issues. The difficulty of finding one-size-fits-all solutions to help low-income families emerged in this discussion. Practitioners noticed their clients’ debt increasing in the years since the most recent recession, suggesting ongoing or deepening hardships. The types of debt seemed to be changing, with practitioners reporting more interest in borrowing for higher education and micro-enterprise rather than home ownership. As a result, one respondent indicated a notable increase in education-related debt and predatory lending practices that quickly escalate student debt. Finally, all the participants expressed strong interest in untangling “good” credit from debt as a liability. Respondents would like to understand how credit can be used wisely for investment in assets, to allow the build up of savings, or serve as launching pad to continually make progress and achieve goals.

The full DIALOGUE report includes more detailed findings, and a summary of the discussion with the practitioners and policymakers. Download the full dialogue [pdf].

Read the full report by Marieka Klawitter and Colin Morgan-Cross here.