The African Union, in an August 2025 report, estimates that illicit financial flows (IFFs) cost countries in Africa $88 billion per year. IFFs are illicit or illegal funds derived from criminal activities and/or illegal tax practices that are moved or transferred across countries, including international trade manipulations (the most common), tax evasion, smuggling, government corruption, and money laundering. Nearly half of these losses come from the ‘extractive sector,’ mostly mining. IFFs are fundamental drivers of economic injustice, and enormously undermine…

Category: Tax Evasion

Malawi and Mali Demand Unpaid Taxes and Royalties from Multinationals

BBC news recently reported that the governments of Malawi and Mali are demanding hundreds of billions of dollars from U.S.- and Australia-based multinationals to compensate for unpaid taxes and royalties over the past 10 years. Charles Gitonga and Andre Lombard report that the Malawi government has accused Colombia Gem House, U.S.-based gemstone company, of not paying fairly for rubies exported over the last 10 years. The government is also demanding $4 billion from French gas giant TotalEnergies in unpaid revenue…

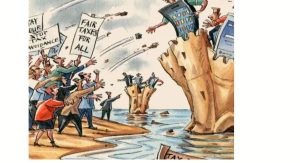

Fair Taxation: Urgent Call for action in G20 and UN

Oxfam’s February 2024 analysis reveals a troubling trend: the wealthiest 1% in G20 countries are benefiting from significantly reduced tax rates, widening the gap between the rich and the rest. This alarming disparity, coupled with a decline in democracy, underscores the urgent need for policy reform. As finance ministers convene in São Paulo, they must prioritize fair taxation policies that promote equality and support for all citizens. The proposal to implement a 5% wealth tax on multimillionaires and billionaires could…

UN Tax Reform offers hope to Low Income Countries

In late November 2023, developing countries at the UN won a historic vote to set up a tax convention in spite of resistance from rich countries. This Guardian editorial (see below) explains how poor nations’ ability to feed, educate and provide healthcare to their people is hobbled by illicit and hidden movements of capital worth billions each year. The Tax Justice Network (also below) documents how countries around the world are losing US$480bn in tax a year to tax abuse, with…

Countries on course to lose $4.7 trillion to tax havens over next 10 years

The tax justice network recently released its 2023 State of Tax Justice report that estimates that, if no action is taken, countries will lose nearly US$5 trillion in tax to multinational corporations and wealthy individuals using tax havens to underpay tax over the next 10 years. Lower incomes countries’ tax losses ($46 billion) are equivalent to more than half (56 per cent) of their public health budgets. Check out the report! The State of Tax Justice 2023

Is Bill Gates a barrier to fair taxation?

Fair taxation is fundamental to global health. Taxes provide the necessary resources to finance strategies to improve health, including social determinants of health (education, nutrition, housing, water, sanitation) and health care. Taxes provide resources for the public health infrastructure that is essential to implement and scale up the technologies and programs developed by the Gates Foundation. Taxes are also a mechanism to reduce the unconscionable income and wealth inequality that enormously impacts global health. As important as it is, fair…

[PODCAST] USA – global leader on the 2022 Financial Secrecy Index

Naomi Fowler (Tax Justice Network) May 2022: “We’re hearing a lot from world leaders about sanctions against Russian oligarchs at the moment. We know financial secrecy is what the powerful, the corrupt, and criminals really love. With financial secrecy they can undermine the democratic will of any country’s government. They can drain the tax revenues that stop the rest of us living secure and happy lives. So which nations are the world’s worst offenders when it comes to financial secrecy? I’m…