The African Union, in an August 2025 report, estimates that illicit financial flows (IFFs) cost countries in Africa $88 billion per year. IFFs are illicit or illegal funds derived from criminal activities and/or illegal tax practices that are moved or transferred across countries, including international trade manipulations (the most common), tax evasion, smuggling, government corruption, and money laundering. Nearly half of these losses come from the ‘extractive sector,’ mostly mining. IFFs are fundamental drivers of economic injustice, and enormously undermine…

Tag: resource mobilization

Barred from Healing: Denial of Qualified Medical Care Deepens Humanitarian Crises

This article is written in Arabic and English. For the English version, please see below. في مناطق النزاع حول العالم، يمكن أن يكون الوصول إلى المهنيين الطبيين المؤهلين هو الفارق بين الحياة والموت. ولا يوجد مكان يتجلى فيه هذا الأمر أكثر من غزة، حيث أدى الحصار المتعمد على العاملين في مجال الرعاية الصحية الماهرين إلى تفاقم كارثة إنسانية متزايدة. أحد الحالات الرمزية هو حالة الدكتور محمد الموسوي محمد طاهر، الجراح البريطاني-العراقي المتخصص في جراحة الصدمات والمعروف بمساهماته الاستثنائية خلال مهمة…

Re-imagining foreign aid

Farah Stockman in her NY Times editorial decries the chaos and devastation from cuts in US foreign aid, but also calls for re-imagining a foreign aid that addresses serious flaws inherent in the current forms of aid. We know that local groups (especially under-funded government health systems) are far more cost-effective and attuned to what communities need – and stay long after foreign workers depart. Cutting out the middlemen is essential, and more cost-effective – as leaders in the global…

Malawi and Mali Demand Unpaid Taxes and Royalties from Multinationals

BBC news recently reported that the governments of Malawi and Mali are demanding hundreds of billions of dollars from U.S.- and Australia-based multinationals to compensate for unpaid taxes and royalties over the past 10 years. Charles Gitonga and Andre Lombard report that the Malawi government has accused Colombia Gem House, U.S.-based gemstone company, of not paying fairly for rubies exported over the last 10 years. The government is also demanding $4 billion from French gas giant TotalEnergies in unpaid revenue…

Rewriting the Script of Global Health

In the heart of Rwanda, a pharmaceutical revolution is unfolding, disrupting a global health order long dominated by high-income nations. This bold move by a nation determined to chart its own course in healthcare sovereignty embodies the spirit of decolonizing global health. It serves as a testament to the possibility of a world where equity in health is not just an aspirational goal but an actionable reality. This narrative of empowerment and systemic change ignites the conversation around decolonizing global…

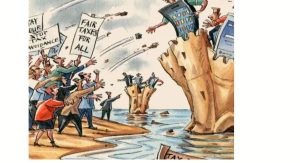

Countries on course to lose $4.7 trillion to tax havens over next 10 years

The tax justice network recently released its 2023 State of Tax Justice report that estimates that, if no action is taken, countries will lose nearly US$5 trillion in tax to multinational corporations and wealthy individuals using tax havens to underpay tax over the next 10 years. Lower incomes countries’ tax losses ($46 billion) are equivalent to more than half (56 per cent) of their public health budgets. Check out the report! The State of Tax Justice 2023

[BOOKS] on Phantom Aid

“Phantom Aid” refers to the phenomenon where foreign aid is promised but not effectively delivered, often due to corruption, mismanagement, or other systemic issues. Here are recommended books to explore the topic more: “The White Man’s Burden: Historical Origins of Racism in the United States” by Winthrop D. Jordan (1974) This seminal work offers crucial historical context on how racial perceptions have influenced foreign aid efforts, providing a foundation for understanding the complexities of aid dynamics. “Dead Aid: Why…

Is Bill Gates a barrier to fair taxation?

Fair taxation is fundamental to global health. Taxes provide the necessary resources to finance strategies to improve health, including social determinants of health (education, nutrition, housing, water, sanitation) and health care. Taxes provide resources for the public health infrastructure that is essential to implement and scale up the technologies and programs developed by the Gates Foundation. Taxes are also a mechanism to reduce the unconscionable income and wealth inequality that enormously impacts global health. As important as it is, fair…